Geopolitical tensions have kept up demand for light sweet crudes because of a potential disruption to natural gas supplies following Moscow’s move to build up troops at the Ukranian border, even though Russian officials have repeatedly said they have no intention of invading the country. Most refiners use hydrogen produced from natural gas to remove sulfur from sour crudes. Russia’s exports of its main export grade Urals is projected to slump to a five-month low in February because of production issues.

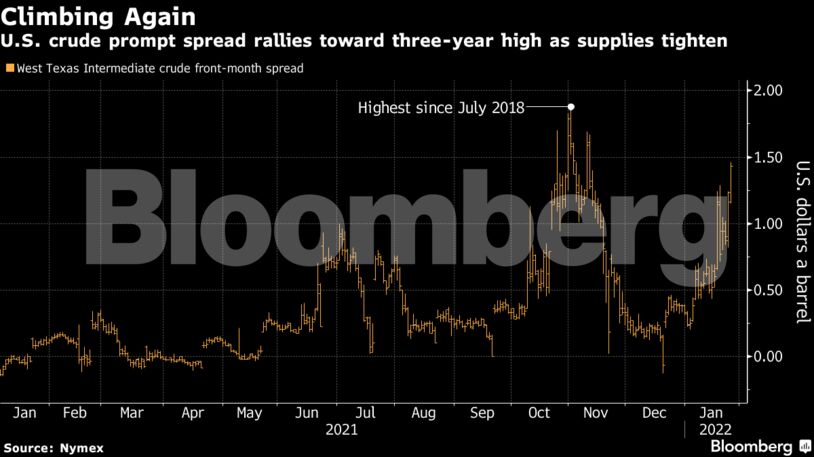

Oil prices for physical delivery in the Gulf Coast strengthened to the highest levels since 2020 this week, attracting more flows to the region instead of Cushing, Oklahoma, the delivery point for benchmark U.S. crude futures. Crude flows on the Basin Pipeline, a key conduit for shipments from the Permian to Cushing, have been muted as a result of the pricing dynamics and is likely to support spreads strengthening further, traders and brokers said.

Inventories in Cushing this month sank to the lowest levels in a decade seasonally. Last week, inventories fell for a third straight week to 31.7 million barrels, data from the U.S. Energy Information Administration showed.

“WTI spreads are all about tank bottom worries,” said Kit Haines, an analyst at consultant Energy Aspects. “Everything is so tight right now, crude products, gas. Pick one, there’s not enough.”

For March loading, Permian sweet crude cargoes are trading as high as 50 cents a barrel above Brent futures, holding steady from February, according to people familiar with the matter. Pipeline supplies of February WTI at Midland, Texas, and at Houston firmed to the highest since 2020 on Tuesday.

Some of the strength in physical crude prices are also due to traders rolling positions forward to the next month during the switch to March trading from February.

Traders are also keeping a close watch on the upcoming refinery maintenance season for signs that crude demand may ease. But with profit margins for refining so strong, the facilities that are running may pick up the slack for those that close for work, some traders said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS