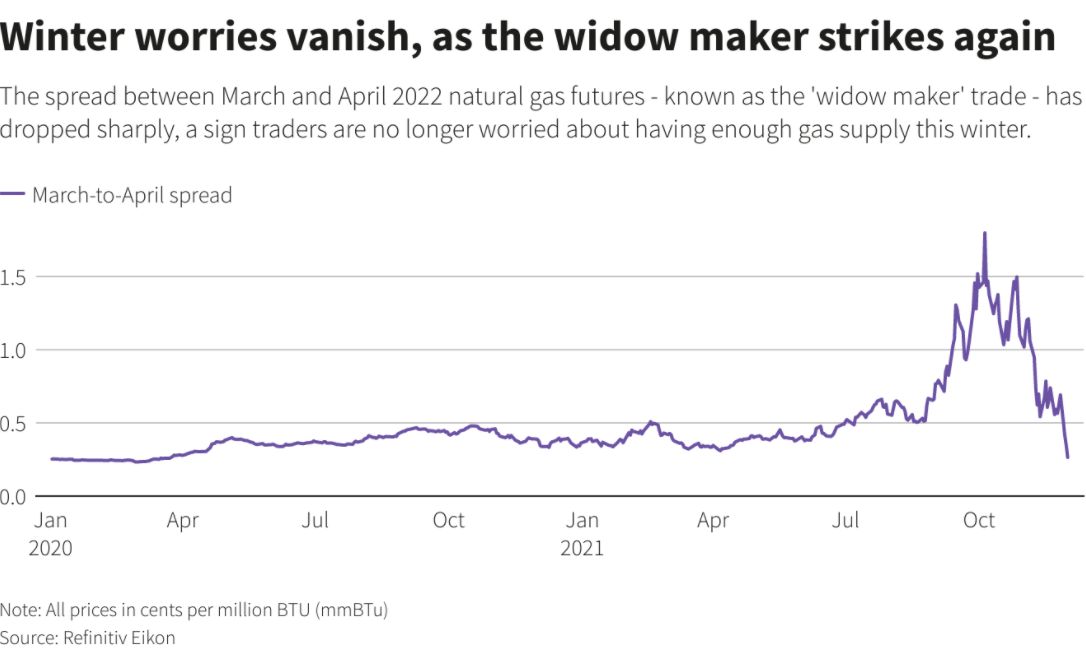

Just two months ago, U.S. gas futures were signaling alarm that the nation may not have enough gas in storage to adequately supply homes and businesses with heat throughout the winter. With December’s arrival, however, forecasts have shifted dramatically, and the futures market shows it.

Gas futures dropped to a three-month low on Wednesday, and more notably, the famous market trade known as the “widow maker” has hit a 20-month low, a signal that gas stockpiles are in good shape for the next few months.

The “widow maker” trade, known as such because rapid changes in price have knocked speculators out of business, refers to the spread between gas contracts expiring in March and those expiring in April.

March is considered the last winter contract, as it is the last month when utilities are usually pulling gas out of storage – while April is the first month when utilities start injecting gas back into storage. A wide spread indicates a big need for supply, while a small gap between the two means utilities think there’s enough gas in storage.

The premium of gas futures for March over April fell to 28 cents per million British thermal units (mmBtu) on Wednesday, the lowest since March 2020.

That is a massive narrowing of the spread, which hit a record $1.80 in early October when the markets worried about tight U.S. gas supplies during the winter because stockpiles were over 6% below normal and output was slipping.

“It’s one of the biggest futures meltdowns ever,” said Bob Yawger, director of energy futures at Mizuho in New York.

Now, however, U.S. inventories are just 2% below normal for this time of year after mostly mild weather in October and November allowed utilities to stockpile huge amounts of gas.

In the past, a sharp move in the March-April spread has squeezed funds caught on the wrong side of that trade. Amaranth’s hedge fund notably lost more than $6 billion on gas futures in 2006 on such a trade.

Output in the U.S. Lower 48 states averaged a record 96.5 billion cubic feet per day (bcfd) in November, up from 94.2 bcfd in October, according to data provider Refinitiv. That easily topped the prior all-time monthly high of 95.4 bcfd in November 2019.

The entire global energy complex collapsed over the past week on concerns demand will fall as coronavirus cases rise, causing a supply glut. Oil prices fell to their lowest since August earlier on Wednesday.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet