Traders widely expect the Organization of Petroleum Exporting Countries and its allies to defer a modest increase in output. But discussions so far among delegates are focused on pushing ahead with a planned 400,000 barrels a day hike, taking a pause, or something in between the two.

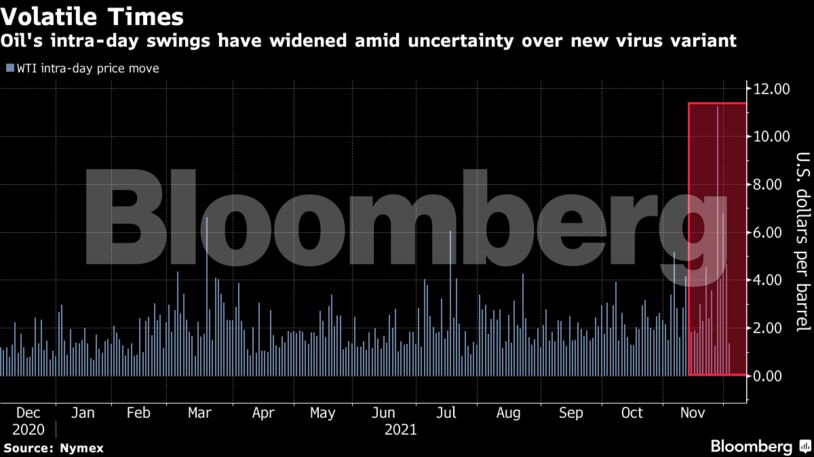

The recent selloff in prices has stretched all the way along the futures curve. The key Dec.-Red-Dec. spread, a gauge used by traders to bet on the health of the market, is at its weakest since February. Options markets have been roiled too, with volatility soaring to its highest since May last year.

Oil has dropped more than 20% since late October on a White House-led coordinated reserves release and, more recently, the new virus variant. An increasingly hawkish tone from the Federal Reserve is also weighing on the growth outlook for the U.S. economy. A major, as yet unanswered, question is whether existing virus drugs will work against omicron.

“We’ve been saying a pause in December for three months,” said Paul Horsnell, head of commodities research at Standard Chartered. “Add in an omicron effect and its hard to see how the increases can continue.”

The first infection of the new strain was detected in the U.S., while cases in South Africa doubled from Tuesday. Still, there are those who think oil’s drop has been overdone. Goldman Sachs Group Inc. said prices have “far overshot” the impact of omicron. Bank of America Corp. said it was sticking to its $85-a-barrel forecast in 2022, with possible surges past $100 if air travel rebounds.

| Prices |

|---|

|

As OPEC+ gathers, there are continued negotiations around the revival of the Iran nuclear deal. Officials from the country presented proposals for the process of sanctions removal, local media said, though there remains little sign of an imminent deal to return supply to the market.

The U.S., meanwhile, is sticking to its guns on the reserves sale even as prices crash. There are no plans to alter the announced release of 50 million barrels “in timing or size,” the Energy Department said in a statement. American crude stockpiles fell by 909,000 barrels last week, less than the median estimate in a Bloomberg survey, Energy Information Administration data show. Gasoline inventories climbed by more than 4 million barrels.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS