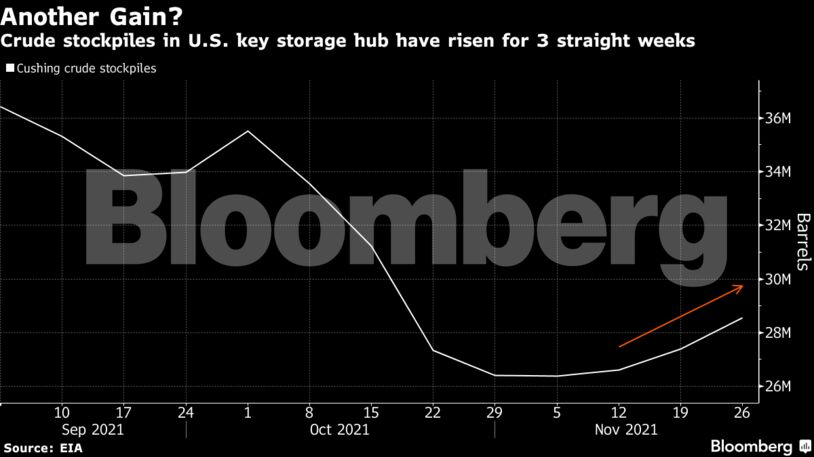

Prices were under pressure earlier, following American Petroleum Institute estimates that crude inventories at the U.S. storage hub in Cushing, Oklahoma, rose by 2.4 million barrels last week — the biggest increase since February. Traders will be looking to see whether government data due later on Wednesday confirms the findings.

“Cautious optimism is prevailing that the hit from omicron on the global economy and thus energy demand will be less than initially feared,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates Ltd.

China continues to tackle sporadic outbreaks, with one eastern city locking down a district to curb the spread. Omicron has led to some restrictions on air travel, and researchers in South Africa said the strain’s ability to evade vaccine and infection-induced immunity is “robust but not complete.” They added that booster shots would likely reduce chances of infection.

| Prices |

|---|

|

U.S. crude inventories fell by 3.1 million barrels last week, the API said. That would be the largest draw since September if confirmed by the Energy Information Administration. The EIA is expected to report stockpiles fell by 1.5 million barrels, according to the median estimate in a Bloomberg survey.

Over the past week, some traders have bet on the small chance that WTI’s discount to Brent will surge past $10 a barrel next year. The long-shot wager is a signal that some market participants believe the Biden administration could intervene in the market again to bring down prices following a pledge to sell crude inventories from strategic reserves.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Why Congress’s New Budget Should Eliminate All IRA “Tax Credits” – Alex Epstein