The U.S. said over the weekend that chances of Iran rejoining the nuclear deal may be slipping away. The briefing was one of the most pessimistic American assessments of the negotiations yet, dampening any expectations of a quick return of Iranian oil to the market.

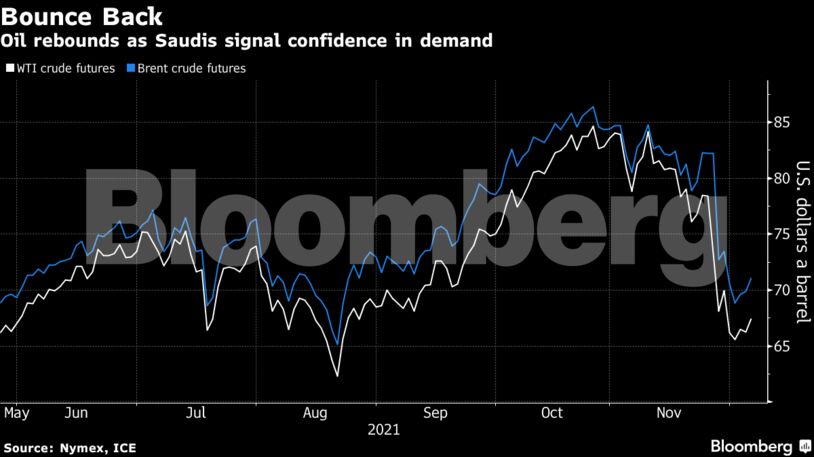

While oil dropped for a sixth consecutive week of declines — the longest stretch since 2018 — it has begun to recover from the stark drop at the beginning of last week, when omicron led to renewed restrictions on travel. OPEC+ decided to keep adding extra barrels to the market in January, essentially putting a floor under prices by giving itself the option to change the plan at short notice.

Oil is seeing “a continuation of last week’s recovery” and “a bit of extra spice by Saudi OSPs,” said Ole Hansen, head of commodities strategy at Saxo Bank.

| Prices |

|---|

|

Saudi Aramco raised its key Arab Light grade for customers in Asia by 60 cents from December to $3.30 a barrel above a benchmark, according to a statement from the state producer. That followed comments last week from Aramco Chief Executive Officer Amin Nasser that he was “very optimistic” about demand and that the market had overreacted to omicron.

White House medical adviser Anthony Fauci said Sunday that there doesn’t look to be a great degree of severity to the new strain, while cautioning it’s too early to be certain. Omicron has so far spread to at least 17 U.S. states.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS