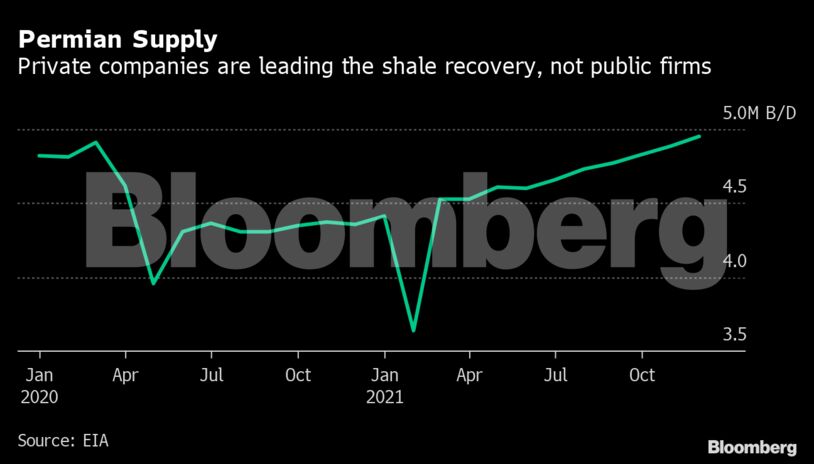

Its bounce back has been driven by low break-even costs, and the largest U.S. drillers are almost exclusively focusing their limited domestic plans for expansion on the sprawling oil patch, at the expense of other shale basins. Total U.S. output is still a long way off from a full recovery.

One reason drillers aren’t incentivized to boost output in other basins is because most market observers estimate that the global oil market will become oversupplied next year. Last week, the Energy Information Administration projected that global oil supply is set to average 101.42 million barrels a day in 2022, while worldwide demand is seen at 100.88 million barrels a day.

Still, record Permian output won’t be enough to significantly reduce oil prices in the near future as long as overall demand continues to outpace supply.

Production in the Bakken in North Dakota and the Eagle Ford in South Texas are both still down from pre-Pandemic levels. Output in other shale regions is set to rise modestly with gains ranging 2,000-5,000 barrels a day, the agency said.

The backlog of oil wells that have already been drilled and are waiting to be fracked, known as DUCs, have sunk to the lowest volume since 2014, the agency said in its Drilling Productivity Report.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein