As much as 60 million barrels could be released from the SPR, in part by bringing forward mandated sales from 2022, according to Citigroup Inc. That would be enough to wipe out the supply deficit that the Energy Information Administration has forecast for the rest of this year.

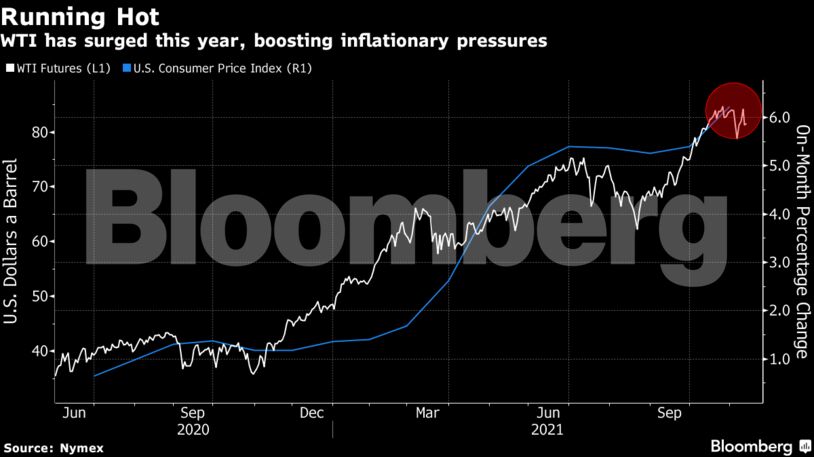

With the economic recovery from the pandemic boosting demand, draining stockpiles and fanning inflation, crude prices have been on the rise for much of 2021. Despite the upswing, the Organization of Petroleum Exporting Countries and its allies have been returning supplies only gradually, arguing that prudence is still merited as risks to global consumption remain.

“The market is in wait-and-see mode,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. “Everyone is waiting for the next move of the U.S. administration.”

| Prices: |

|---|

|

The slump in U.S. benchmark prices on Wednesday came as data showed an increase in nationwide crude stockpiles, although inventories at the key storage hub in Cushing, Oklahoma, declined. Separately, data showed U.S. consumer prices rising at the fastest annual pace since 1990 last month.

With the market keenly watching for potential U.S. steps, trading has been highly volatile. One closely monitored market gauge — the spread between the nearest two December contracts — has swung by more than a dollar in four of the last six trading sessions, when it would generally move a few cents.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS