Futures in New York traded near $76 a barrel after losing almost 6% last week. President Joe Biden has been talking about a possible release from the Strategic Petroleum Reserve for several weeks, and Japan’s TV Asahi reported Monday that Tokyo is preparing to release crude from its national stockpiles as part of a joint effort with the U.S.

The return of virus restrictions in Europe, meanwhile, suggests there could still be a threat to global energy demand from a resurgent Covid-19. Austria was back in full lockdown on Monday, while Chancellor Angela Merkel said the latest surge in infections is worse than anything Germany has experienced so far.

“The debate about releasing strategic oil reserves continues,” said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt. At the same time, “oil demand could be dampened considerably” as “the virus spreads much more rapidly in the winter.”

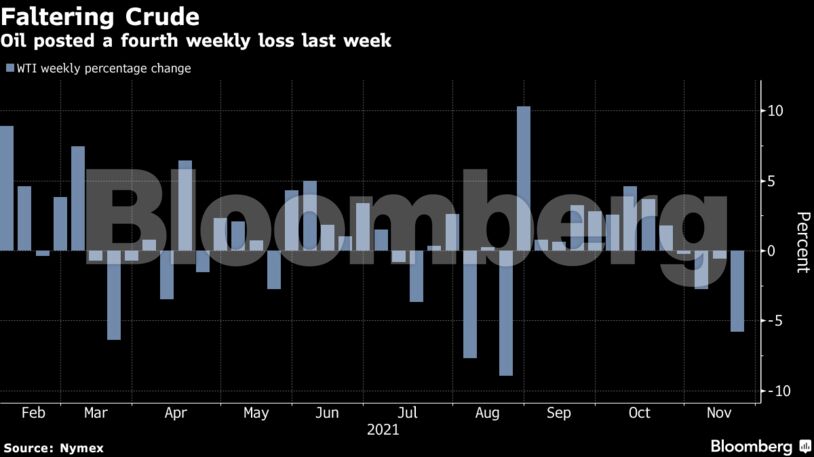

Oil has fallen from a high in late October as speculation increased that the U.S. and other countries would release reserves. Any national sales will need to be fairly substantial to move prices further, with Goldman Sachs Group Inc. saying last week that the impact of around 100 million barrels of reserves auctions was already priced into the market.

An internationally coordinated release would, however, send a powerful message to the OPEC+ alliance, which has so far resisted calls to restore supply faster. Biden and Chinese President Xi Jinping talked about the merits of utilizing strategic reserves during their virtual summit last week. China indicated last week that it was working on another sale from its national inventories.

- West Texas Intermediate for January delivery slipped 0.2% to $75.84 a barrel on the New York Mercantile Exchange by 12:45 p.m. London time; the front-month contract tumbled 3.7% on Friday.

- Futures lost 5.8% last week.

- Brent for January settlement fell 0.2% to $78.75 on the ICE Futures Europe exchange after declining 2.9% on Friday.

Tokyo has determined it can use its stockpiles legally as long as it taps surplus supply, according to the TV Asahi report, which cited an unidentified government official. It didn’t provide further details on how much oil would be released.

Other market news:

- Saudi Aramco said it will continue to look for investment opportunities in India, days after Reliance Industries Ltd. scrapped a plan to sell a stake in its oil-to-chemicals unit.

- Colombian front-runner Gustavo Petro said his first decision as president would be to stop awarding oil exploration contracts, according to an interview with El Tiempo.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Why Congress’s New Budget Should Eliminate All IRA “Tax Credits” – Alex Epstein