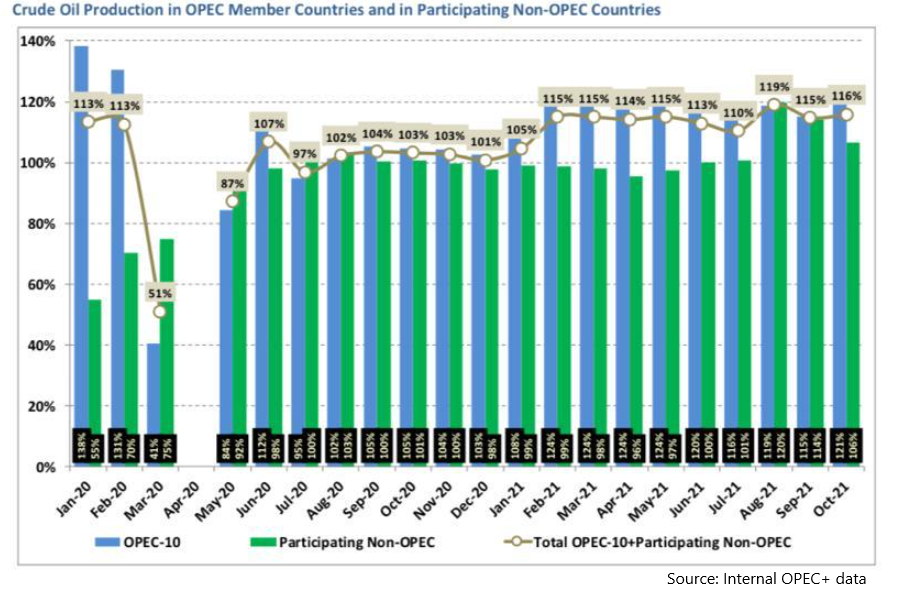

The International Energy Agency (IEA) said OPEC+ production was below its target in both September and October by more than 700,000 barrels per day (bpd) and analysts expect this to continue as the group’s targets rise going forward.

OPEC and the IEA have been predicting an oil surplus in the first quarter of 2022. But the production shortfall by OPEC+, which groups the Organization of the Petroleum Exporting Countries and it allies, means tighter conditions may persist longer and crude prices could rise further.

WHY IS OPEC+ MISSING THE MARK?

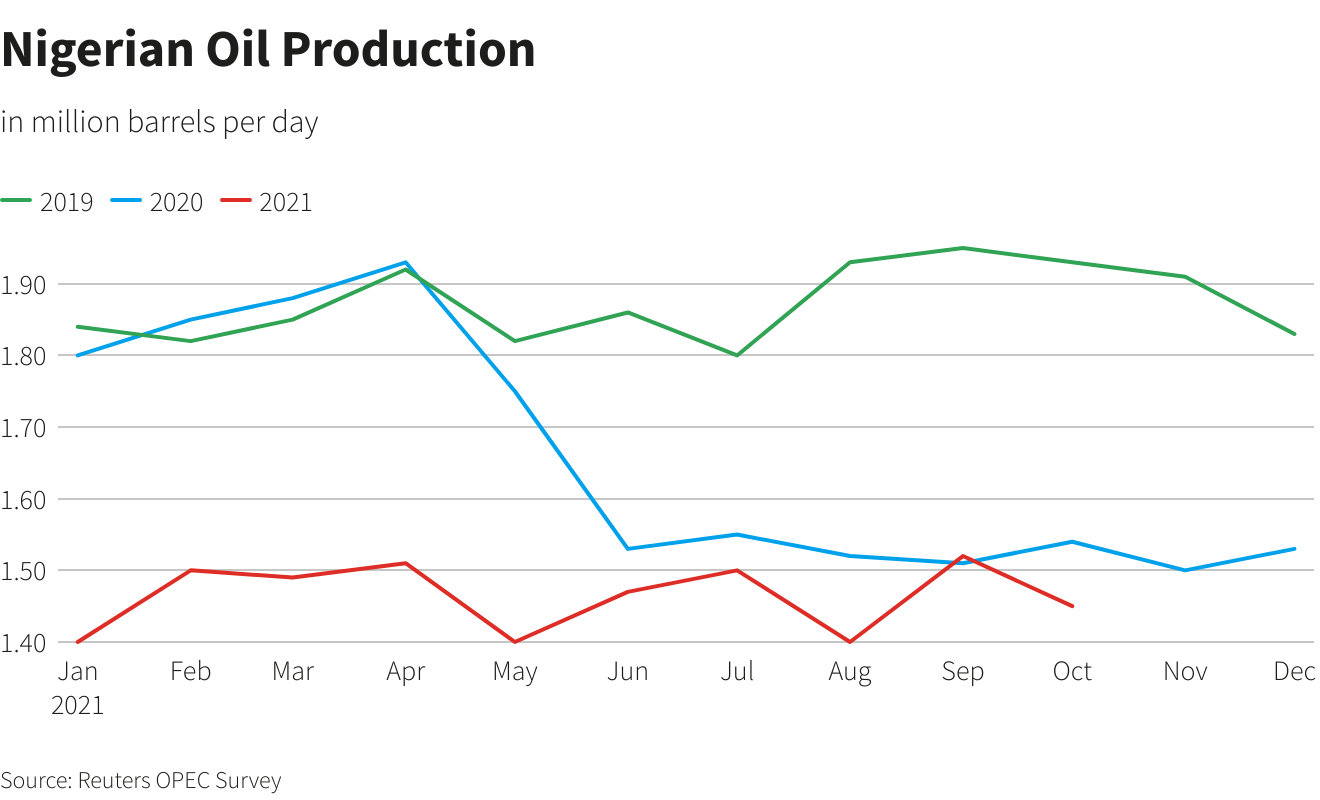

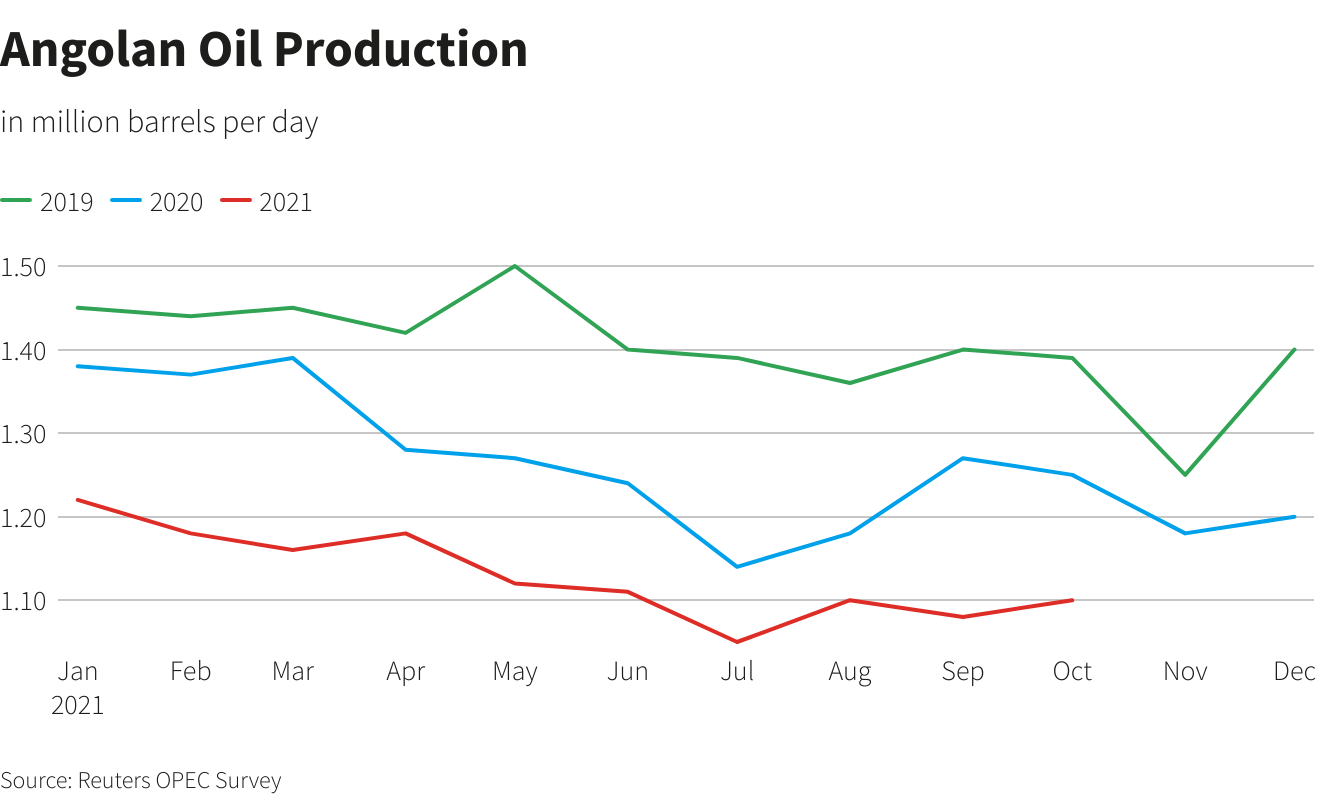

OPEC members Nigeria and Angola are the main under-performers, as their oil industries grapple with an exodus of oil majors, years of underinvestment, maintenance issues and unplanned outages.

The two countries accounted for almost 90% of the 730,000 bpd of the OPEC+ production shortfall in October, the IEA says.

WHAT DOES THIS MEAN FOR THE MARKET?

The IEA said this month it expected global demand in the first quarter of 2022 to average 98.5 million bpd, lagging supply by about 1.1 million bpd.

OPEC sees global demand at 98.02 million bpd in the first quarter. It does not publish a forecast for future production, but internal data in October showed the group expected a surplus of about 2.5 million bpd in the first three months of 2022.

The U.S. Energy Information Agency (IEA) forecasts first quarter demand at about 99.83 million bpd, slightly below its forecast for supply of 99.9 million bpd.

The IEA expects Nigerian output to reach 1.46 million bpd in the first quarter, up 110,000 bpd on the previous quarter, and sees Angola’s output rising by 30,000 bpd to 1.17 million bpd.

OPEC and the EIA do not provide forecasts by country.

Assuming OPEC+ sticks to its plan to raise output by 400,000 bpd each month, the IEA is expecting Nigeria and Angola to continue miss targets by more than 400,000 bpd, based on Reuters calculations, a slight improvement on the October shortfall.

But if production from the two countries faces any disruption, the market could look tighter in the first quarter.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso