By Current SCM

When you think of a bullwhip, your mind might envision something out of an Old Western or Indiana Jones.

But the Bullwhip Effect is actually an important concept in economics and supply chain management.

This article guides you through the Bullwhip Effect in supply chain, and how it might have a much greater effect on you than you realize.

What Is The BullWhip Effect in Supply Chain?

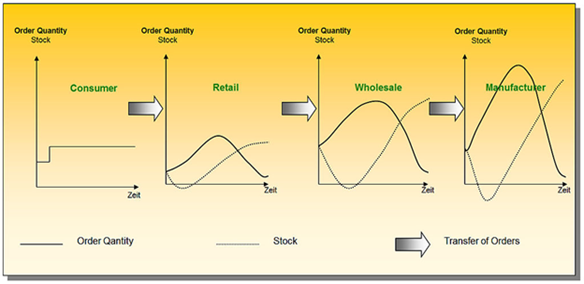

The bullwhip effect (also known as the Forrester, whiplash, and whipsaw effect) is present in just about every supply chain. A bullwhip takes place when the forecasts for consumer demand do not coincide with real world demand for products and services.

When this disparity between forecasts and real-world economics occurs, an inventory gap or inventory lag slowly grows its way up the supply chain. A ticking time bomb.

The end result is multiplicatively more severe upstream than when it began at the end consumer. Stretching from end users all the way up to the raw material producers.

So, a small shift in consumer demand can propagate up the supply chain. Due to the longer procurement cycles of suppliers and producers, this small change in demand can become a massive wave of inventory shortage or excess.

When graphed out the results look very much like a whip. With the handle being held by the end consumer, and the amplitude increasing as it moves upstream in the supply chain.

Courtesy of Creative Commons: Grap.

More succinctly:

“The observed propensity for material orders to be more variable than demand signals and for this variability to increase the further upstream a company is in a supply chain”.

–Lee H. 1997.

The BullWhip Effect On Oil & Gas

Because of the complexity of supply chains and procurement management in a global economy (specifically Oil & Gas), the exact catalysts for this bullwhip effect in supply chains is often debated. Consumer goods have relatively consistent consumption patterns, so forecast accuracy is high. But this accuracy falls sharply as forecasts move upstream due to lag time, and disjointed communication.

A famous example of the bullwhip effect from a communications angle comes from Volvo. In the 1990s, their consumer operations faced a massive inventory of green colored cars. Naturally, Volvo began offering these vehicles at a steep discount.

But upstream, the manufacturing elements of the supply chain only saw the increase in sales. They assumed this green model was in high demand. So instead of clearing unpopular inventory, production of the vehicle grew.

So intense is this bullwhip effect that a 10% shift in point-of-sale demand can be interpreted by upstream supply chain members as an up to 80% shift in demand.

While the exact causes escape formal definition, some general factors that exacerbate the bullwhip effect in Oil and Gas are:

- Disorganisation

- Lack of communication

- Order grouping

- Price variations

- Demand disinformation

We can take a deeper look at these causes by separating them into Behavioral and Operational catalysts.

Behavioural Causes

Humans are fallible and will often attempt to guess future demand or the actions of others. This leads to the following mistakes:

Disconnects between inventory controllers

Natural miscommunications between separate inventory management entities create unnecessary supply chain inefficiencies. Current SCM excels in resolving supply chain communication issues.

Under/over-estimation of the supply chain resource pipeline

Attempts to ‘guesstimate’ the future resource needs of an entire supply chain is impossible. Yet there are constant gluts and droughts of resources due to this estimation game.

The complementary bias

This Bias occurs when two parties with the same beliefs attempt to both change the status quo for the better without communicating their actions. This leads to both parties compounding the problem instead of reducing it.

Misuse of stock policies

The longer the supply chain is, the bigger the supply delays will be. The most upstream user will only discover the decline of the demand weeks later.

Operational Causes

Operational causes are often more easily fixed than behavioral, as operational causes commonly do not carry ingrained biases in decision making.

Order Batching

In an attempt to minimize costs and smooth supply streams, firms will try to “round up” their orders. This leads to overstocking and can cause serious financial headaches when demand falls. Overstocking creates unnecessary volatility in inventories and worsens the bullwhip effect.

Rationing and Gaming

The reverse of complementary bias, rationing and gaming occurs when suppliers limit their order fulfillment to save costs. The buyer will then begin over-ordering to counteract this. As the back and forth continues a larger and larger disparity in ordering and information sharing occurs.

Price Fluctuations

In an attempt to combat inflationary pressures, discounting, Oil & Gas companies often purchase more inventory than they need. Especially if the inventory is long tailed and will not be used for some time. The idea is to make inventories last just long enough to make it to the next delivery. As you can guess, this risky operation brings volatility when supply or demand changes.

Demand Forecast Updating

Like a game of telephone. The more members there are in a supply chain, the more forecast updating occurs among and between different upstream units in the chain.

The more units, the more safety stock is required within the supply chain. And therefore the greater the artificial increase in demand. Once the demand exceeds the forecasted demand sufficiently, a Bullwhip Effect begins.

In the Oil and Gas industry, these sorts of inefficiencies hamper operations in a few ways. Some of the costliest effects include:

- Losing orders for components and parts for oil manufacturing processes due to long lead times, backlogs, and capacity issues.

- Massive capital loss due to holding vast amounts of inventory after a high demand period.

- Capital loss from holding excess capacity after a boom, expecting the high demand to continue.

The early stages of the COVID-19 pandemic caused a bullwhip effect that no amount of rationing or safety stocks could have managed. The rush for consumer goods and fuels led to massive feedback loops of hoarding and panic buying. This caused an unprecedented spike in demand which reverberated through the Oil & Gas economy for months.

How You Can Fight The Bullwhip Effect

The digital transformation brought on by Industry 4.0 has revolutionized the way supply chains share information. Even if a supply chain is disjointed by dozens of vendors. The right software and data sharing can smooth the communications upstream, thereby greatly reducing the costs of the Bullwhip Effect. Current SCM is one such software.

One commonly used concept is that of Kanban. The idea of instant and persistent transmission of supply chain data for a single source of truth. By having near perfect information of up and downstream supply chain operations, inventories can be smoothed. Shocks to the system can be reduced or even averted.

Another popular strategy to combat the Bullwhip Effect in supply chains is order smoothing.

If the Bullwhip Effect can be seen as a rock being dropped into a still pond. With the ripples being shocks to supply chains. Order smoothing would be increasing the viscosity of the water. Ripples are more easily absorbed and do not travel nearly as far along the supply chain.

However, the most tried and true methodology to combat the Bullwhip Effect requires reducing variability, uncertainty, and lead-time.

Some options include:

- Demand driven Material Requirements Planning

- Strategic partnerships along the supply chain

- Just in time replenishment of inventories

- Information sharing

- Inventory and order smoothing

- Eliminating incentives such as long-lasting return policies, and allocations based on previous sales

Current SCM And The Bullwhip Effect

Current SCM’s unique and highly customizable project management features help to better support your organization and meet the challenges of future projects and scale operations. Perfect information sharing, inventory controls, bidding, order tracking.

Whatever you need, whenever you need it. All at the click of a button. Reduce shocks to your supply chain by introducing a perfect information system to your operations.

If you need help transforming your operations or organizational support systems or would like to see a customized demo of Current SCM, contact us today.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS