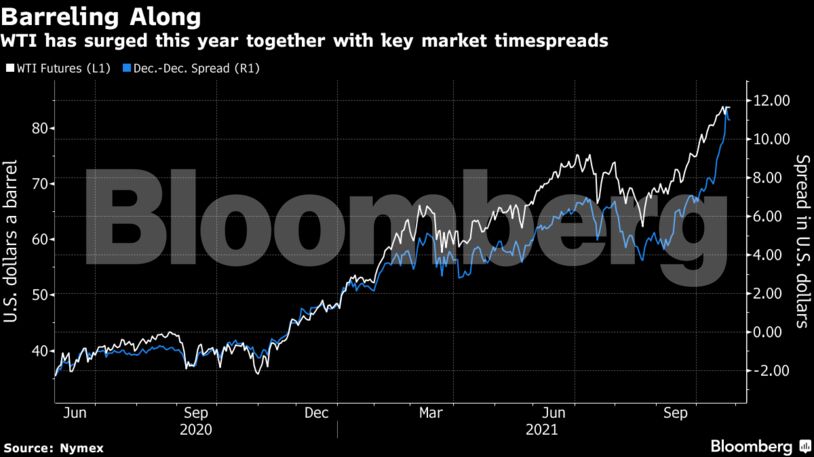

Brent crude edged lower from its highest close in three years. Later Tuesday, the American Petroleum Institute will report estimates for U.S. oil inventories, including at the key hub in Cushing, Oklahoma. A sharp drawdown there in recent weeks has led to huge moves in timespreads for both Brent and West Texas Intermediate as traders pay premiums for more immediate supply.

The Organization of Petroleum Exporting Countries and its allies are due to gather next week to assess output policy against a market backdrop in which investors are expecting even higher prices. Larry Fink, chairman and chief executive officer of BlackRock Inc., the world’s largest asset manager, said there’s a high probability that crude could hit $100 a barrel.

Oil in both London and New York is set for a monthly gain as global demand recovers from the pandemic and amid a broader energy crunch. While OPEC is gradually easing output curbs, Wall Street has been looking nervously at global spare capacity. Most banks now see crude trading higher for a longer period of time as demand recovers, but underinvestment in new supplies means production could fail to keep pace, a concern shared by BlackRock’s Fink.

“Short-term policy related to environmentalism, in terms of restricting supply of hydrocarbons, has created energy inflation, and we are going to be living with that for some time,” Fink said at the Saudi Future Investment Initiative conference.

| Prices: |

|---|

|

The crude market’s pricing structure remains deeply backwardated, a bullish pattern in which near-term prices are more costly than those further out. Brent’s prompt spread — the difference between its nearest two contracts — was at 70 cents a barrel, though it has fallen sharply since Monday morning.

Traders also are keeping tabs on talks that eventually may help revive an Iranian nuclear accord, allowing a pickup in crude exports. Discussions between Tehran and the European Union are due to be held in Brussels on Wednesday, part of a drawn-out effort to clear the way for a wider diplomatic push.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein