Exxon Mobil Corp. and Chevron Corp. report on Friday, with BP bookending the results on Nov. 2.

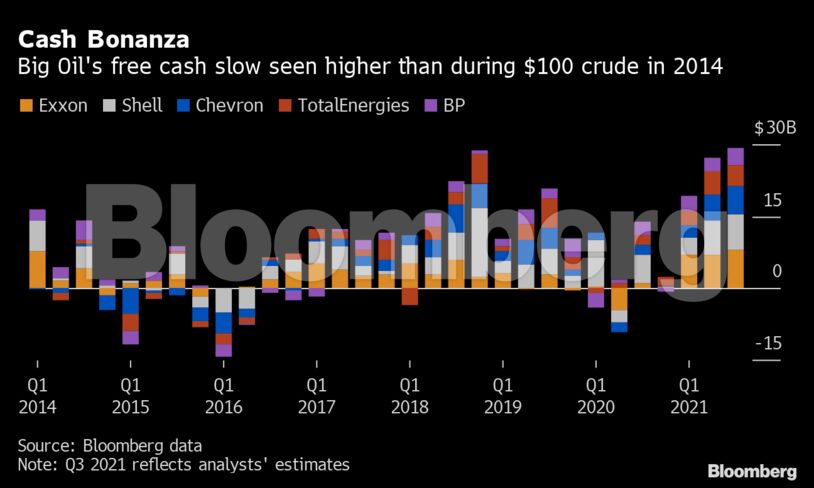

Executives at publicly traded oil companies have so far this year been keen to reinforce their commitment to spending discipline, even in the face of soaring commodity prices that would have prompted a raft of fresh spending on new megaprojects in previous boom cycles. Instead they’re focused on paying down debt and returning cash to shareholders following a decade of weak financial performance even before the pandemic, plus emerging risks posed by the energy transition.

As such, Exxon investors will be focused on the “path forward for incremental shareholder returns” this quarter, Goldman Sachs analysts wrote in a note. Chevron also has the potential to increase its share buyback, according to Morgan Stanley. BP could announce $600 million worth of incremental buybacks in the third quarter, while Shell might hold off on further repayments until the final quarter of the year, Jefferies analyst Giacomo Romeo wrote in a research note. France’s TotalEnergies has already promised to buy back $1.5 billion of shares in the fourth quarter.

Still, buybacks and dividends aren’t the only option for all that cash. With Europe and Asia short of gas, and the U.S. and India calling for OPEC+ to produce more oil, the profit incentive to drill for more fossil fuels is increasing as the majors plan their 2022 capital budgets. Executives should be cautious in overcommitting to shareholder returns because the good times might not last, according to HSBC.

“As strong as the near-term financial outlook is for the sector, we aren’t convinced the oil and gas prices driving the latest rally are sustainable,” London-based analyst Gordon Gray said in a note, citing continued valuation headwinds over energy transition risks.

What to Watch For:

- Gas boom

- Average European gas prices almost doubled quarter on quarter, while in the U.S., Henry Hub jumped 45%

- Exxon signaled a gain of about $700 million from natural gas in a Sept. 30 trading update

- Gains from liquefied natural gas sales often trail the market by a few months, meaning sky-high spot prices may only feed through in 4Q

- Refining rebound

- Gulf Coast crack spreads increased 11% quarter on quarter, while in Europe they rose 16%, according to Morgan Stanley

- Exxon’s downstream division should end four consecutive quarters of losses

- Jet fuel demand is improving, boosting Chevron’s large West Coast refineries

- Chemicals strength

- Higher natural gas liquid-input costs may erode chemical margins from the second quarter, but demand remains high for petrochemicals that go into plastics, benefiting Exxon and Shell in particular

- Gulf Coast prices for PVC, used in water pipes and window frames, touched a record high in the second quarter

- Trading

- Shell and BP have vast trading operations that can add billions to their bottom lines every year

- Shell appears to have been on the right side of big swings in gas and power prices, with the company flagging that its gas trading desk performed better than in the second quarter

- BP hasn’t disclosed any updates on its trading unit, but its gas and power desks did get off to a good start this year due to a winter freeze in Texas that sent prices soaring

- Oil

- Brent crude averaged $73.26 a barrel in the third quarter, compared with $69 a barrel in the second quarter

- Production from the Gulf of Mexico took a major hit when Hurricane Ida damaged key oil infrastructure, forcing some facilities to shut down for weeks

- Oilfield servicers Baker Hughes Co. and Halliburton Co. suffered earnings knocks due to the hurricane

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire