Although U.S. crude inventories rose, the volume at the storage hub of Cushing fell by about 3.73 million, according to people familiar with the data. It would be the biggest decline since January if replicated in official figures released later Wednesday.

There’s particular concern about the slumping volume at Cushing, which is the delivery point for U.S. crude futures and one of the largest storage hubs in the world. As demand has rebounded this year, holdings at the site have sunk to the lowest since 2018, with traders now fretting that inventories could hit minimum operating levels, supporting higher prices and wider time spreads.

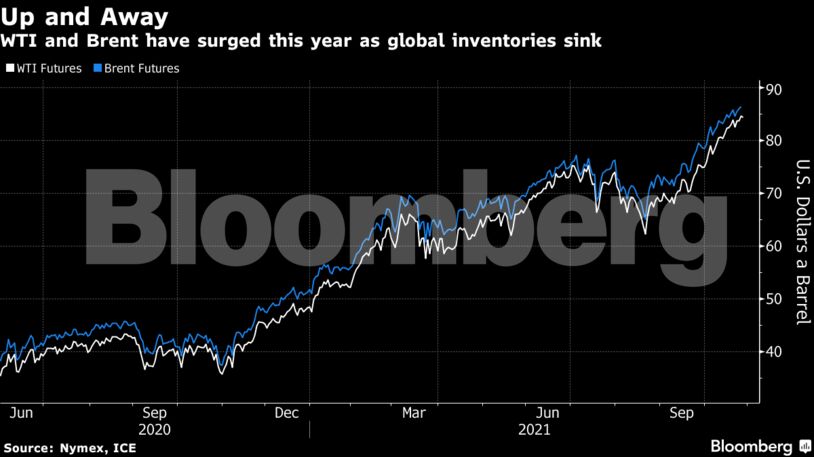

Oil has soared this year as worldwide consumption expanded, a broader gas-centered energy crunch added demand and the Organization of Petroleum Exporting Countries and its allies have restored supplies at only a modest pace. That’s got executives looking at the prospect of prices staying high, after BlackRock said this week that it’s likely crude will hit $100 a barrel.

“Generally we think the oil price will stay at a high level,” Anders Opedal, Chief Executive Officer of Equinor ASA said in a Bloomberg Television interview. “We are seeing that demand for oil is coming back to the 2019 levels.”

| Prices: |

|---|

|

In China, fuel retailers are rationing diesel volumes to customers as it ramps up efforts to avert a supply shortage of the fuel. Diesel has been one of the main beneficiaries of the country’s energy crunch as it can be used to power smaller generators.

The spike in energy costs has raised alarm within the Biden administration. The U.S. will continue to pressure OPEC and remains concerned about gasoline prices, White House Press Secretary Jen Psaki said at a briefing on Tuesday.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS