“Many of these commitments will be converted into concrete and robust action,” said Michael Urban, senior sustainability analyst at Lombard Odier Investment Managers. This could “provoke a significant shift in climate-related market expectations, and this could also happen abruptly,” he added.

The stakes couldn’t be higher. Bank of America Corp. strategists estimate $2.3 trillion of global stock market value could be wiped out by the turn of the century because of changing climate policies.

But as more countries join the chorus of net-zero pledges and negotiators make progress on global carbon-market talks, the transition also means more winners. BofA estimates that a third of global equity inflows are now heading to funds with a sustainability label.

Here’s a guide to the stocks that may benefit or suffer from stronger green commitments.

Winners: Renewable Utilities and Energy-Storage Makers

An accelerated push to produce and store renewable energy will benefit firms including Ganfeng Lithium Co., Panasonic Corp., and Iberdrola SA, according to Morgan Stanley strategists led by Jessica Alsford. Also on the firm’s recommended list are electric-car maker Tesla Inc. and hydrogen pioneer Siemens Energy AG.

BofA recommended 26 stocks to buy ahead of the COP26 summit, including Aker Carbon Capture ASA, to ride the wave of the emerging technology of carbon storage, as well as biofuel firms such as Raizen Energia SA and Neste Oyj.

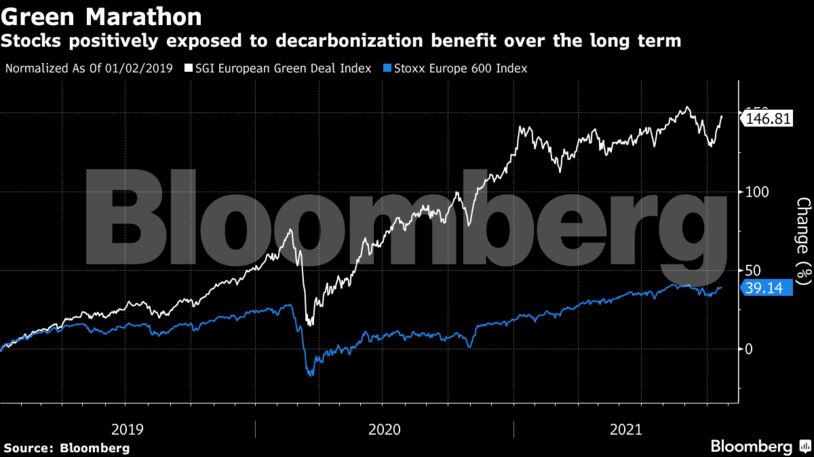

Lombard Odier’s Urban says the most promising investment opportunities lie with companies that have big plans to decarbonize, such as Nippon Steel Corp., which is working on hydrogen technology to reduce emissions.

Green Firms Rush to List in Europe Amid Energy Crisis: ECM Watch

Berenberg Bank’s top picks include insurer AXA SA because of its plan to eliminate coal from its global business by 2040.

The market for makers of wind turbines, solar panels, lithium-ion batteries, electrolyzers and fuel cells could be $27 trillion if the world gets on track for net-zero emissions by 2050, according to estimates by the International Energy Agency.

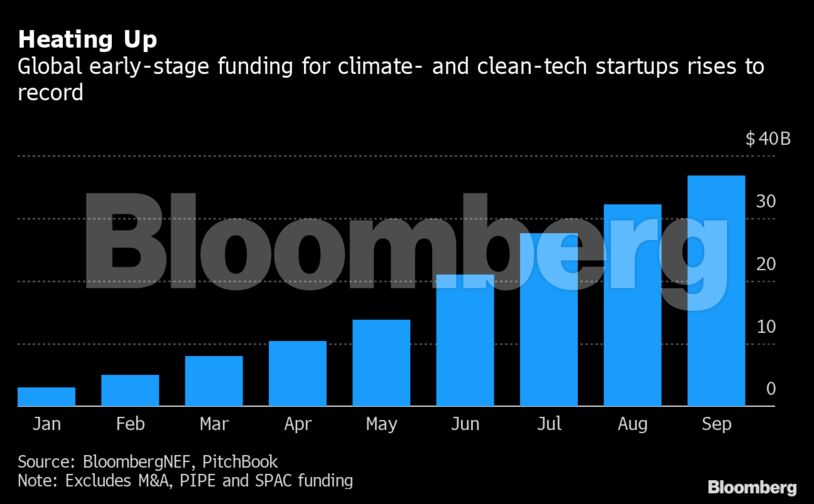

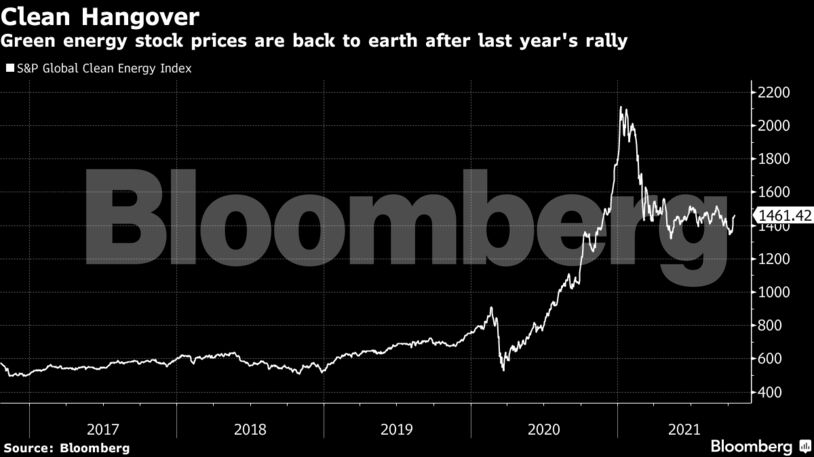

Clean energy companies could use the boost, after taking a hit this year on worries about frothy valuations, giving up some of 2020’s massive gains.

Goldman Sachs Group Inc. analysts reckon that COP26 could prove a catalyst for a turnaround. Market expectations are high, judging by the recent rebound in the European Renewable Energy Index — up about 14% since an 11-month low on Oct. 8.

A successful COP26 “would set the tone for policy change over the medium to long-term,” says Wai-Shin Chan, head of the Climate Change Centre at HSBC Holdings Plc.

Losers: Chemical Makers and Transport Stocks

Greener regulation would be a challenge for high-emission sectors such as airlines and shipping, while an expansion of carbon pricing policies would add to cost pressures for chemical makers, according to Morgan Stanley.

Its list of underweight stocks ahead of COP26 includes American Airlines Group Inc., and companies that will lose as coal is phased out, including Yanzhou Coal Mining Co. and China Coal Energy Co.

Societe Generale SA strategists advise cutting exposure to oil and related stocks. The highest-polluting sectors are likely to fare worse in equity and credit markets as investors become choosy about carbon footprints, the strategists led by Alain Bokobza wrote in a note.

Looking beyond individual stocks, even countries that are more reliant on fossil fuels, such as Poland, will face greater headwinds, according to Andrzej Pioch, multi-asset fund manager at Legal & General Investment Management.

For companies, the move toward sustainability may also come with greater compliance and accounting costs, and environmental taxes. The European Central Bank, for example, has asked lenders to estimate the risk they could face from climate change in their lending and trading operations when they undergo a stress test next year.

Strategists at UBS Global Wealth also note the potential impact of climate change itself on assets. Real estate portfolios with property in coastal areas face risks from extreme weather, they say.

The transition also has implications for the macroeconomic landscape. It can add anything from a few tenths of a percentage point of inflation to as much as 3% in an extreme hypothesis, according to Amundi SA, Europe’s largest asset manager.

It will also shave 0.4% of global economic output per year to 2050, says Vincent Mortier, Amundi’s deputy chief investment officer.

More imminently, if carbon prices rise “too high, too quickly” as a result of policy decisions emerging from COP26 summit, it may hurt global growth, says Roland Kaloyan, head of European equity strategy at SocGen.

Lastly, listed companies coping with the demands of decarbonization — aligning with Net Zero by 2050 and the United Nations’ sustainable development goals — may have no choice but to pass on some costs to shareholders, according to Goldman Sachs.

“In other words, they would have to dilute shareholders (raise equity), forgo dividends or raise debt finance to pay for further investment,” analysts led by Guillaume Jaisson wrote in a note.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS