By Geoffrey Cann

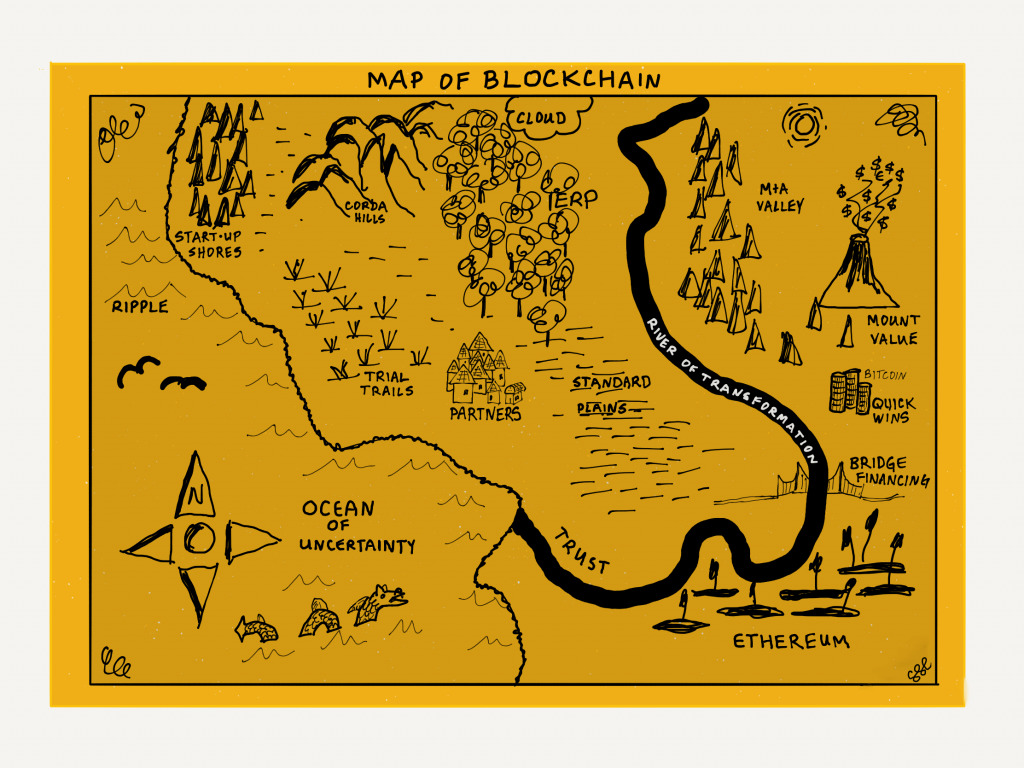

Will there be one blockchain to rule them all in oil and gas? Very definitely not, if my conclusions are correct.

The One Blockchain Idea

I’m chairing a panel discussion this week on the topic of blockchain futures as part of the 5th Annual Blockchain In Oil and Gas conference, organized by the Energy Conference Network. The conference covers the broad waterfront topics about blockchain usage in oil and gas, including the very compelling early use cases (sustainability, water handling, materials traceability, joint venture management) convergence with other technologies (internet of things, autonomy) and powerful features (smart contracts, consensualized data, trusted transactions).

One ambitious concept harboured by some in the industry, notably proponents of specific blockchain protocols, is that the industry will need to settle on a single protocol for all its needs. My panel will take this idea head on. This post is a précis of the likely directions of the conversation.

The Origin Story

The Lord of the Rings trilogy paints a fun background analogue to the panel. The book, and the multiple movie series about the book’s story, describes the classic hero journey about a young Hobbit named Frodo, who sets out on a quest to destroy a family heirloom, a ring, with a terrible power. The ring belongs to Sauron, an evil force, and with the ring Sauron can control a series of related rings that belong to other races of that time (elves, dwarves, and men) and with the control, bend them to his will and enable a cruel regime of orcs, trolls, goblins and other creatures. The catch phrase from the Trilogy is “one ring to rule them all”.

Why would such an idea, that there will be one blockchain to rule them all, even take hold? There are many good reasons, it turns out:

The right one way: Oil and gas has a long and proven history in adopting one way to do things, certainly at the business model level. The industry as we know it today (financing, exploration, production, transportation, refining, distribution, wholesale, retail) is the brainchild of one John D. Rockefeller, the original oil baron of the 1870s, who sorted out the inefficient and fragmented early oil refining sector in the US by buying out inefficient competitors and remaking them to his model.

Standardized products: The refining industry takes the huge range of crude oils available and creates thoroughly fungible refined products (gasoline, diesel, jet fuel, marine fuel) that are completely indistinguishable from each other. One product specification that everyone adopts allows us to buy gasoline from any fuel station without concern about product quality or variance.

Cost capture: The oil and gas industry is a scale industry. From individual oil wells that produce 100k barrels per day to gigantic refineries that refine 1m barrels per day, the industry functions best at scale. It has been relentless in pursuing cost take out wherever it can. A tolerance for diversity is often the enemy of a low cost operation, and the notion that multiple blockchain protocols will persist appears to be cost additive in a world that favours scale.

Through this lens, the oil and gas industry certainly looks like it favors the one-ring maxim.

Blockchain Questions

The panel will address several questions about the one ring idea:

- Will there be one blockchain to rule them all?

- What is the role and opportunity for interoperability and standards to help drive adoption in the industry while promoting adequate diversity?

- What are other industries doing with regards to standardization, interoperability and diversity of solution?

- What is the biggest blocker of blockchain adoption?

- Where will we be in 2-3 years with regards to blockchain usage in the industry?

ONE BLOCKCHAIN?

If Rockefeller was still in charge, there is no doubt we would have one blockchain protocol. As an accountant, he made it his life’s work to remove cost and inefficiency from the oil and gas industry. And he was rather successful at it. His net worth at time of death was $300-400 billion, and fully 2% of US GDP. We all think of Amazon’s founder Jeff Bezos as pretty wealthy, and he is (Forbes ranks him as the world’s richest billionaire with wealth of $181b) but he’s not in John D’s league.

There was no information technology back then, but in my view, Rockefeller would intuitively view more than one competing way to accomplish the same outcome as inherently inefficient.

However, we are no longer in Rockefeller’s age. Technology innovation does not behave in the same manner as innovation in pumps and valves. Different blockchain protocols offer very different values and solve different problems. Government rules about data privacy may make it impossible for specific data held on a blockchain (geologic records, for example) to be held outside of a jurisdiction, leading to multiple geography-based solutions.

In the western liberal democracy context, diversity of technology solution is actually viewed as a virtue. Diversity promotes creative discovery and innovation, whereas a single endorsed solution drives innovation away to other endeavours. A free and open playground attracts capital and talent with better ideas. That’s why we have many messaging protocols, many video services, many on-line marketplaces.

The oil and gas industry is attuned to the potential for rent seeking behaviour, driven by monopolies with control over some essential capability. It’s very easy to command a rent from oil and gas, as the product (oil, petroleum) often has a robust margin that can tolerate a little rent. The industry typically avoids putting itself into the position of vulnerability from rent seekers, including technology companies.

Illiberal economies, those that are more or less directed by national governments, may take a very different approach. I would not be surprised in the least if China simply forbade some blockchain protocols from being used in the country, in favour of those protocols that the government prefers.

INTEROPERABILITY AND STANDARDS?

If we are in a world of multiple protocols, then how are we going to address the 100% probability of incompatibilities between the protocols? To illustrate, consider a private blockchain solution that allows an operator to correctly pay royalties to joint venture partners. The solution depends on having the precise identity of the venture partners and their relative ownership position in the producing properties. In parallel, the regional government moves its land registry records to a different blockchain solution on a very different protocol. These two chains are linked by the common data of land and ownership. A change in the registry should be reflected in the royalty position.

Dig into the details of the blockchain protocols and a myriad of differences surface, from technical (protocol structures, update rules, validation mechanisms) to commercial (valuations, ownership, maintenance roles, governance). The rules to solve for starting a smart contract on one chain based on one protocol and ending that contract on another chain need to be put in place. It would be simpler if there were fewer protocols involved, but for now, that’s an elusive hope.

One path the industry could take is to promulgate standards that help solution developers operate without having to constantly check for compatibility and interoperability. Oil and gas is already very comfortable with standards, and has plenty of practice in writing, testing, and rolling out common ways of doing business, in areas like safety, design, materials, and products.

Another path is to adopt architectural solutions to interoperability problems, such as middleware products, that serve as the interface or a pathway of exchange between protocols. The stock market is a good example of a kind of exchange, where stocks all settle, but the participants in the stock markets are free to use their own solutions to develop products, handle trades and manage customers.

Repsol is following this path through its investment in Finboot, a middleware blockchain product that insulates solution developers from having to work directly with blockchain protocols.

SUCCESSES FROM OTHER INDUSTRIES?

A handful of industries are further ahead in addressing the challenges of interoperability and standardization. For example, the consumer and packaged goods industry (or CPG) has been an aggressive early adopter of blockchain solutions to provide for tracking of food stuffs through the food supply chains.

Food safety and provenance is a very worrisome concern in many countries where food standards and product safety are less developed. Just a few years ago, tainted pork for sale in southern China could not be traced back through the originating farms, feedlots, abattoirs, processors, packagers, warehouses, shippers, and retailers. Milk products, baby food, produce and many other foodstuffs are now routinely traced through their lifecycle, providing near instant visibility to where products have been handled.

The panel will surface some of the successes from other industries as well as the insights from those who have been less successful.

THE ROADBLOCKS?

Distributed ledger technology was first mooted in 2008 during the Great Financial Crisis (GFC) and is now, for a technology, 12 years old. That’s pretty mature in technology terms, but blockchain is still barely visible in oil and gas. The panel will discuss why that might be, including the following:

- The technology is still not mature enough for a conservative industry.

- The culture of oil and gas is closed to solutions from outside the industry and resistant to change given the emphasis on safety, reliability, integrity and cost.

- The regulatory environment is not settled yet on the role of blockchain technology. As one lawyer put it, ‘smart contracts are neither smart nor are they contracts’.

- The environmental cost of public blockchain technology is counter to the industry narrative of its own environmental sensitivity.

The Future?

The panel will conclude with what the panelists anticipate to be the important future directions of the technology. I can safely forecast that blockchain will not be cast into the fiery pit at Mount Doom, and there will not be one blockchain to rule them all, but beyond that, I’m guessing. Tune in for the exciting conclusion to this question in a followup post, my precious.

Check out my book, ‘Bits, Bytes, and Barrels: The Digital Transformation of Oil and Gas’, coming soon in Russian, and available on Amazon and other on-line bookshops.

Take Digital Oil and Gas, the one-day on-line digital oil and gas awareness course.

Mobile: +1(587)830-6900

email: [email protected]

website: geoffreycann.com

LinkedIn: www.linkedin.com/in/training-digital-oil-gas

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein