The extra supply from OPEC+ comes as one key member – Iran – dashed hopes of a quick return to nuclear talks. The longer that process draws out, the further it pushes back larger volumes of Iranian supply returning to the market.

The market is also having to assess the longer term impact of Hurricane Ida, which had shut some U.S. crude output, but also damaged refineries. Government inventory figures will be released later — although they will cover the period before Ida struck.

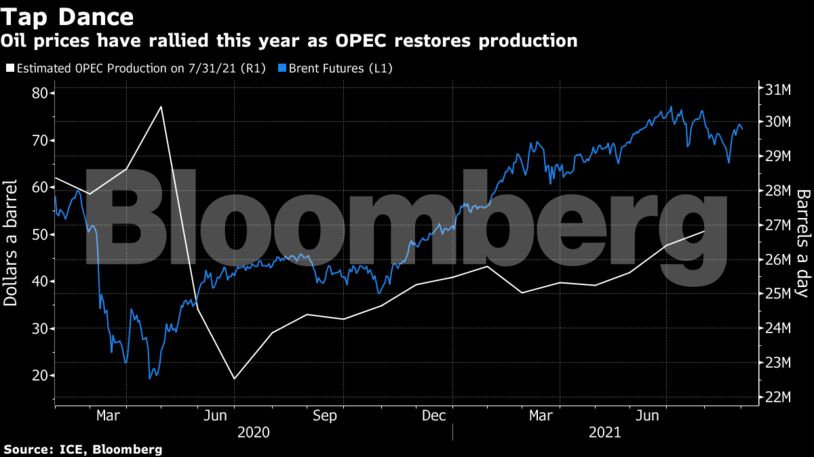

After rallying in the first half, crude’s surge stalled over the past two months amid concern about the spread of the delta variant and a rebound in the U.S. dollar. OPEC+ has been gradually restoring the supply it took offline last year as the pandemic broke out, crushing consumption. The alliance projects that global inventories will continue to drop this year even as it loosens the taps.

“The next price catalyst will likely be today’s OPEC+ meeting,” said Stephen Brennock an analyst at brokerage PVM Oil Associates Ltd. “There is no reason to think it will rock the boat when it comes to its production strategy. OPEC and its partners will stick to their current timetable for increasing oil production.”

| Prices: |

|---|

|

Traders were also assessing figures that pointed to a climb in crude inventories in Cushing, Oklahoma. The industry-funded American Petroleum Institute reported holdings at the key hub rose more than 2 million barrels last week, according to people familiar with the figures. Gasoline stockpiles also gained, although there was a draw in nationwide crude inventories, the data showed, ahead of a government breakdown later on Wednesday.

| Related news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso