But as prices climb there are growing signs governments are growing uneasy with the knock-on effects. U.S. President Joe Biden said Thursday that his administration is looking into high gasoline prices, while China said this week that it will sell oil from its strategic reserve.

Crude markets are backwardated, a bullish pattern that is marked by near-dated prices that are more costly than those further out. Meanwhile products like propane that are used in heating and rally seasonally in the winter are trading at multiyear highs as natural gas prices surge. The oil market should remain tight through year-end, according to Commerzbank AG, despite planned increases by the Organization of Petroleum Exporting Countries and its allies.

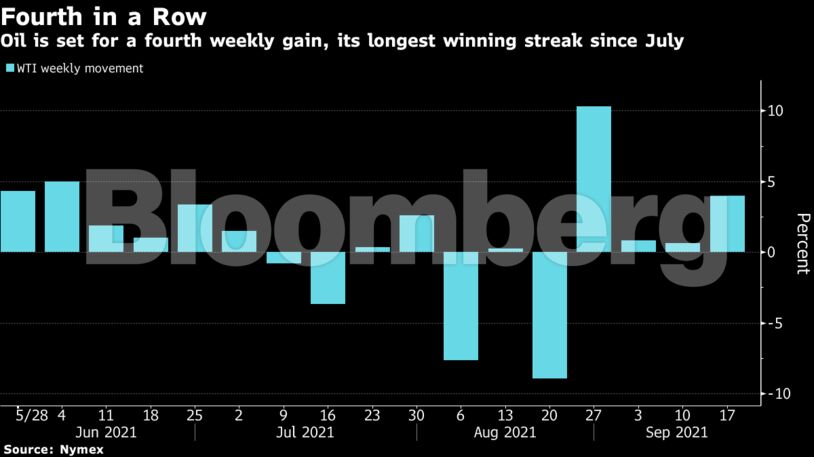

Oil has gained this week due to “tighter oil market conditions, as seen in the recent steep drop in U.S. oil inventories, but also spillover from the sharp rise in European energy prices,” said Jens Pedersen, senior analyst at Danske Bank A/S.

| Prices: |

|---|

|

With the focus on high energy prices across Europe, the International Energy Agency’s Executive Director Fatih Birol said gas prices could remain high for weeks to come on strong demand. He also said he would be surprised to see oil above $100 a barrel, despite a strong rebound in demand this year.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS