“At this point, Ida storm has been quite supportive for oil due to the production disruptions. But as the region recovers and shuttered capacity slowly returns, Ida will be less and less of a supporting factor,” said Bart Melek, head of commodity strategy at TD Securities. Longer term, it will be all about OPEC+, and the delta-variant coronavirus impact on demand, he added.

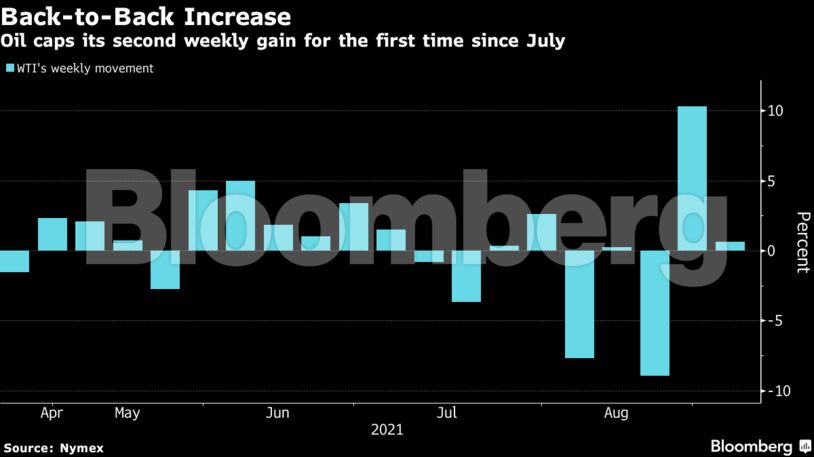

Oil climbed this week as the market appears set to remain in deficit even as the Organization of Petroleum Exporting Countries and its allies push ahead with reviving supply. OPEC+ has said crude stockpiles in developed countries are falling and an economic recovery is accelerating.

There have been signs of revival in Asia, where Covid-19 infections had surged. China’s independent refiners are buying more crude and gasoline consumption in India is improving. The return of Iranian supply, meanwhile, looks even further away.

“Oil prices continue to trade at relatively elevated levels despite OPEC+ reaffirming plans to normalize output and Covid-19 demand woes still present,” said Jens Pedersen, senior analyst at Danske Bank.

Exxon Mobil Corp. is tapping the U.S. Strategic Petroleum Reserve with more than 90% of the Gulf of Mexico’s oil production still shut as of Friday afternoon, while Louisiana’s refineries are still reeling from the impact of the storm.

| Prices: |

|---|

|

Options markets have also mirrored the positive sentiment in crude. The premium of bearish put options for global Brent benchmark over bullish calls fell to its narrowest since mid-June this week. That’s a sign that traders aren’t paying as much to protect against falling prices.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Busting Biases, Boosting Innovation – Geoffrey Cann