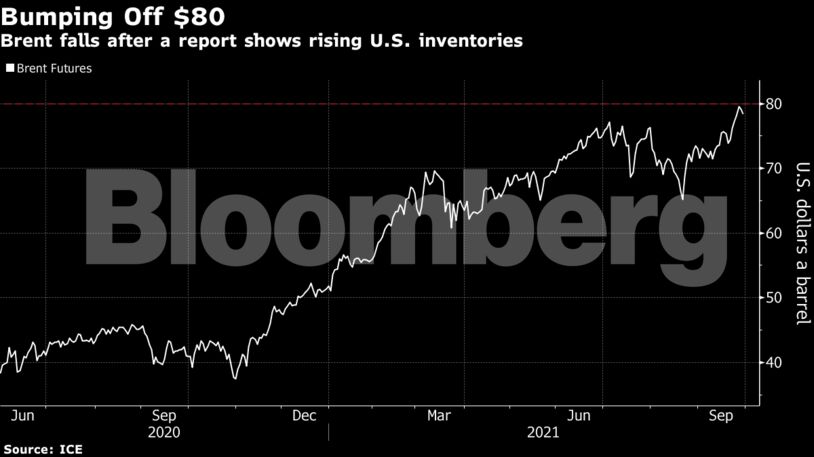

Brent futures slid back below $79, while West Texas Intermediate also dropped. The American Petroleum Institute reported a 4.13 million-barrel weekly gain in U.S. crude stocks, according to people familiar with the data. That would be the first increase in eight weeks if confirmed by government data later Wednesday.

Oil’s advance earlier this week reflected signs of a tighter global market amid stronger demand and rising natural gas prices. Higher energy costs this month have stoked speculation that the Organization of Petroleum Exporting Countries and its allies may ease supply cuts more quickly. The White House said Tuesday it’s continuing to talk to OPEC and other international partners about the importance of competitive markets and doing more to support the recovery.

“The oil market is coming under further pressure this morning after the API reported an unexpected uptick in U.S. oil stocks last week,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates. “The latest price pullback suggests pockets of worry are still present across the oil market.”

| Prices: |

|---|

|

Stockpiles in the U.S. expanded across the board last week, including crude at the key storage hub of Cushing, Oklahoma, according to people familiar with the API data. Gasoline holdings climbed for a second week, rising by 3.6 million barrels, while distillates inventories gained 2.5 million barrels.

| Related coverage: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire