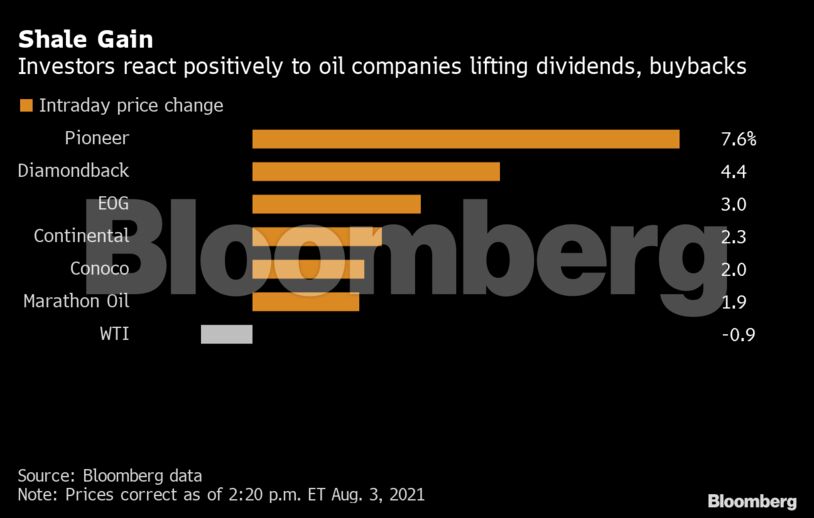

Pioneer’s shares surged almost 8% for the best one-day performance since early December. The Permian Basin’s biggest oil driller is to accelerating a special dividend by six months and ultimately plans to disburse 75% of quarterly free cash flow to investors. In effect, shareholders now are set to receive eight checks a year instead of four.

“This strategy better aligns Pioneer shares to the oil macro and should appeal more to investors,” Scott Hanold, an analyst at RBC Capital Markets LLC, wrote in a note to clients. “This should provide a competitive investment proposition within energy and to other sectors.”

Benchmark U.S. oil futures have advanced 45% this year and at that pace are on track for the biggest annual increase since 2016. In returning so much cash to shareholders, shale drillers are showing they will pass on gains from higher crude prices rather than use them to increase production.

The focus on returns also represents a step-change from the grow-at-all-costs mentality that characterized the industry until back-to-back crude busts and Covid-19 forced explorers to rein in growth.

‘Capital Discipline’

Continental, the oil producer controlled by billionaire Harold Hamm, resumed share buybacks with a $1 billion program more than a year after suspending them. The Oklahoma City-based producer increased dividends by 36% late last week. Meanwhile, Permian explorer Diamondback raised its annual payout by 12.5% and reduced capital spending. Magnolia Oil & Gas Corp. announced its first-ever dividend.

“Oil supply is still purposefully being withheld from the market” by OPEC and its allies, Diamondback CEO Travis Stice said on a conference call with analysts. “There is not a call on U.S. shale production growth. We will continue, therefore to target flat oil production for the foreseeable future.”

Like Pioneer, Continental and Diamondback were rewarded with strong share-price gains in New York trading. By contrast, ConocoPhillips came under pressure from some analysts for not doing enough to enhance shareholder returns.

The largest U.S. independent oil driller posted better-than-expected earnings and is sitting on $9 billion of cash and near-cash equivalents, but opted in June to buy back shares instead of substantially increasing the dividend.

Conoco CEO Ryan Lance said the company is a “leader” in shareholder returns, having promised to return 30% of cash flow, or $6 billion for the year, to investors just weeks ago. “Other companies are only announcing or just reactivating such programs,” he said on Tuesday.

Eagle Ford

Higher gas prices also are benefiting the sector, which has typically regarded the fuel as a costly byproduct of oil. Many producers favored flaring gas rather than spending money on pipelines to take it to market. But high prices have now turned it into a more valuable commodity.

Magnolia said it was directing more spending “toward drilling and completing some gassier wells” in the Eagle Ford region of South Texas.

–With assistance from Cameron Minnard.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS