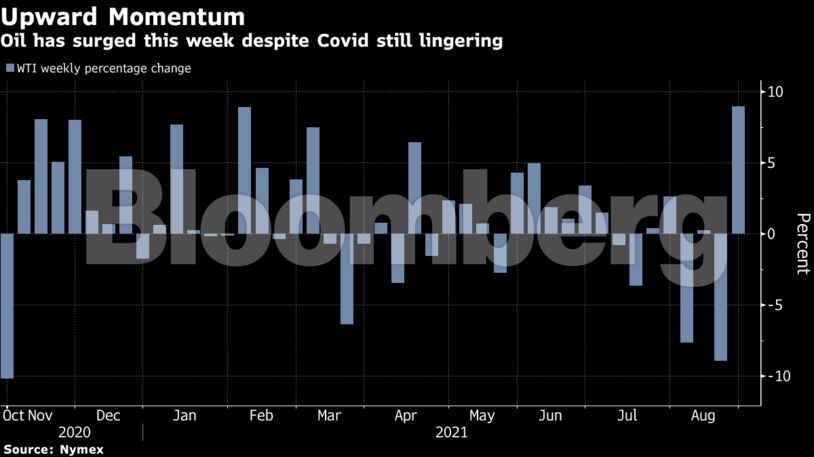

Futures in New York rose above $68 a barrel and are up almost 10% for the week. Oil producers in the U.S. Gulf of Mexico have begun shutting production ahead of Tropical Storm Ida, which will be at least a Category 2 hurricane by the time it makes landfall near New Orleans in the next few days.

The market’s focus is also turning to a speech from Federal Reserve Chair Jerome Powell later on Friday for insights into how bond purchases may be eased. Strength in the dollar has weighed on crude in recent weeks, with commodities priced in the currency getting more expensive.

“As the weather premium makes a return to the energy complex, it is still being overshadowed by a perky dollar,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates Ltd. “All eyes will be on this weekend’s Jackson Hole economic symposium.”

Oil has had a volatile August with the fast-spreading delta variant of the virus leading to renewed restrictions on mobility and clouding the outlook for fuel demand. OPEC+ is scheduled to meet next week after agreeing to keep adding supply until all of its production curbs are revived, and the market will be watching for any change to its strategy.

| Prices |

|---|

|

With Ida heading for the U.S., the nearest WTI timespread has gained. That firming structure comes amid expectations of tighter supplies as production is taken offline in the Gulf of Mexico. The relative strength in U.S. crude has also narrowed its discount to the global Brent benchmark.

See also: China’s Oil Stockpiles Shrink to Lowest This Year on Tight Quota

| Related Ida news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran