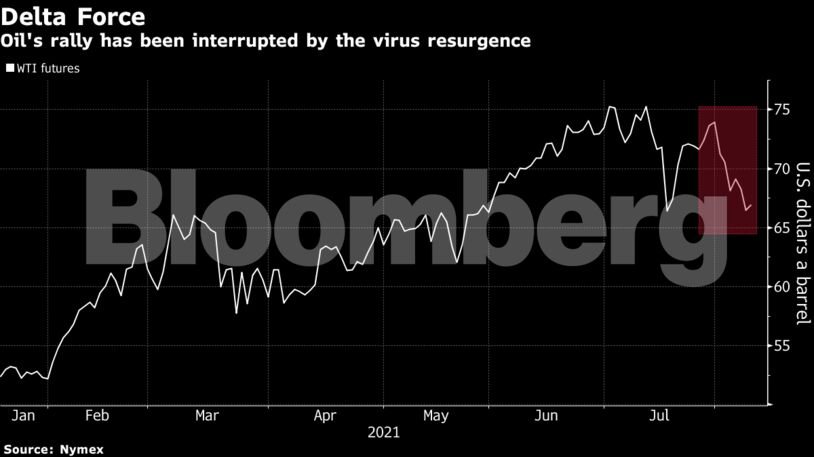

Futures climbed above $67 a barrel in New York, recovering in concert with other commodities, after tumbling almost 4% over the past two sessions. The delta variant has led to rising infections and curbs on movement, most notably in China, where crude refining is set to be scaled back and air travel has slumped. Still, global demand is expected to hold up and tighten the market through the end of the year.

“This turbulence should remain temporary, not the least as western world oil demand is back at or above pre-pandemic levels and is draining global supplies,” said Norbert Ruecker, head of economics at Julius Baer Group Ltd. in Zurich.

In the short-term though, the spread of the virus in Asia, where many countries are lagging behind with vaccination rates, is inflicting a blow on fuel consumption. The pandemic’s resurgence in the U.S., particularly in states where up-take of the vaccine is low, is also sowing concern.

China Petroleum & Chemical Corp., the nation’s biggest refiner commonly known as Sinopec, is cutting run rates at some plants by 5% to 10% compared with previously planned levels this month, according to Jean Zou, an analyst at commodities researcher ICIS-China.

| Prices |

|---|

|

The number of seats being offered by China’s airlines dropped the most since early in the pandemic as the nation implemented fresh restrictions to contain the latest wave, based on data from aviation specialist OAG. Meanwhile in the U.S., virus cases surged to the highest weekly level since early February.

“China’s Covid-Zero strategy means restrictions could continue to widen and tighten, denting oil consumption,” said Vandana Hari, the founder of consultant Vanda Insights. “Delta outbreaks are certainly cause for a revaluation of the earlier anticipated trajectory of the global demand recovery.”

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein