By Clara Ferreira Marques

Energy security, always a worry for China, gained more attention after the Sino-Soviet split in the 1960s ended the supply of Soviet crude. It became a bigger priority when China became a net oil importer in the 1990s. Last year, China accounted for roughly a sixth of global oil consumption. Just over 70% of that came from overseas. Oil and gas from Chinese-held investments abroad satisfied less than a fifth of its domestic demand, and much of that fuel travels through chokepoints like the Straits of Malacca that are vulnerable to a naval blockade, in Beijing’s eyes.

President Xi Jinping’s focus on net-zero emissions by 2060 is, yes, an effort at climate leadership from the world’s largest greenhouse gas producer and a recognition of the importance of environmental goals. But diversifying China’s energy sources and increasing efficiency are valuable aims for reasons that are geostrategic, too. The 14th Five-Year Plan earlier this year paired green ambition with a focus on economic recovery and security, with references to the efficient use of coal, the expansion of oil and gas stockpiles, and exploration at home. Beijing has sought to build up its Strategic Petroleum Reserve. The move away from hydrocarbons is a shift toward alternatives where Beijing has a tighter grasp of the supply chain.

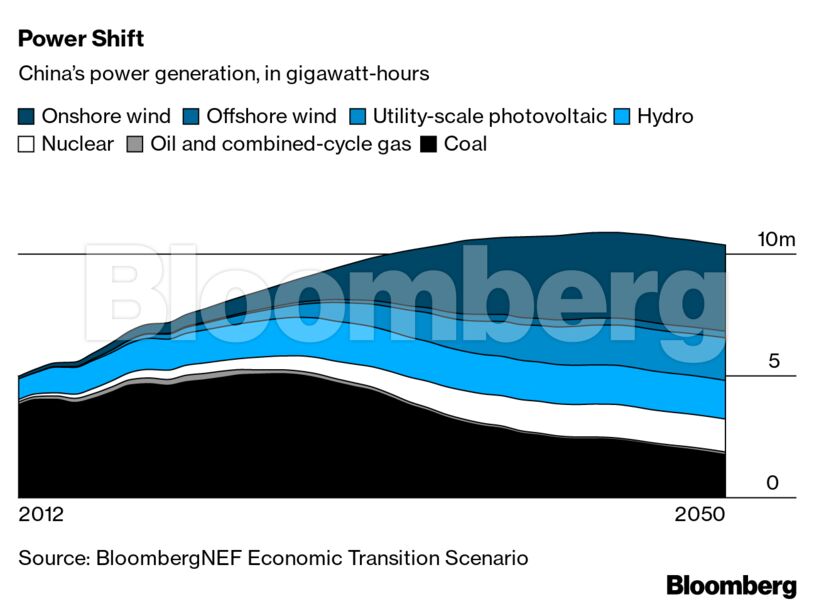

That change won’t be instant. China’s energy consumption increased last year, even as the pandemic led to a drop around the world. Heavy industry is proving tough to decarbonize. The National Energy Administration has come under fire for being too lax on new coal plants, and the dirtiest fossil fuel will still account for more than half of China’s energy mix in 2021. That can’t be reduced quickly; Beijing will continue to lean on coal-fired power as long as economic growth remains the top priority.

China’s oil consumption is also still rising. While it may peak this decade, as China National Petroleum Corp. forecasts, it won’t drop rapidly from there. Much will depend on how quickly China electrifies its passenger vehicle and truck fleet. Bo Kong at the University of Oklahoma, who has written extensively on Chinese energy policy and national security, says oil will also remain necessary for modern warfare. Gas, seen in Beijing as a transition fuel, will take even longer to fade. There won’t be an all-or-nothing switch into solar panels and carbon capture storage.

Still, China’s energy transformation may well come faster than many suppliers and rivals are prepared for.

Consider Russia, which has a political and economic system that leans heavily on hydrocarbons. With no Plan B, it needs Asia, and China in particular, to keep consuming enough fossil fuels to make up for weaker demand elsewhere. So President Vladimir Putin’s government is spending more than $10 billion on railroad upgrades to boost coal exports to big Asian markets. Rosneft PJSC, the country’s biggest oil producer, has ties with its Chinese counterparts. Mainland investment is crucial to Arctic gas plans, too. What happens in Moscow if Beijing moves too swiftly?

Saudi Arabia has also been pivoting toward Asia as Europe sets the pace on decarbonization. China, where Saudi Arabia already vies with Russia as the top oil supplier, is the largest market. While China’s short-term dependence on the Middle East may well increase, the political repercussions of a faster-than-expected shift would be dramatic.

The future looks even bleaker for countries that relied on resource-backed loans from Beijing, and Angola has already pushed back repayments. That’s before considering the impact of shifting energy financing priorities—in June, China’s largest bank scrapped plans to fund a $3 billion coal-fired plant in Zimbabwe.

As the world heads toward a renewable energy mix, Beijing is poised to claim greater control of what comes next. Take cobalt, a crucial component in batteries. Chinese-owned companies have invested heavily in Congo, the world’s largest source of the metal, and dominance is greatest in cobalt refining. It’s a similar story with lithium, where China accounts for almost three-quarters of lithium-ion battery manufacturing capacity. Roughly half of electric cars are made in China.

Greater self-reliance doesn’t have to lead to hoarding or autarky. China will ship battery metals and finished products to the West, too. And, after all, China has been diversifying its energy sources for years, building oil and gas pipelines through neighbors such as Myanmar, Russia, and Kazakhstan to avoid dependence on ocean routes. But an electrifying China will be in a very different negotiating position.

China’s energy consumption has affected its diplomacy for decades. It became a bigger player in the Middle East—where it’s managed to avoid political entanglement, balancing relations with Iran, Saudi Arabia, and Israel—and has ventured into Venezuela and Sudan, pouring overseas development finance into fossil fuel production. As a latecomer to major hydrocarbon investments, China was less able to compete in established jurisdictions, and so it pushed to go where others feared to tread, says Xuanli Liao, a lecturer on international relations and energy security studies at the University of Dundee in Scotland.

It hasn’t always gone to plan. Some investments proved hasty or unwise and some political crises hard to manage. Yuan-denominated oil remains a small fraction of the world crude market, despite China’s efforts to muscle into the U.S. dollar-heavy commodities trade. The idea that owning equity shares of oil fields and producers would significantly increase security proved misguided.

Beijing’s diplomacy doesn’t focus exclusively on satisfying resource hunger. China’s Arctic policy is concerned with access to alternative shipping lanes and broader geopolitical clout, not just oil, gas, or rare earth minerals. In Africa, it’s won political support for its claim to Taiwan—in addition to crude. China’s dispute over territorial claims in the South China Sea isn’t primarily about oil and gas. But energy concerns, so central to national security, are never far away. Energy is the glue for international relationships, even when it’s China that’s building and maintaining the nuclear plants or financing coal power.

That adhesive is changing. The global pivot to a green economy means dealing with different materials and industrial processes. We may still need oil, gas, and coal for some time—but also more copper, nickel, cobalt, lithium, graphite, and even rare earth minerals for renewable energy, batteries, and the leap into electrification.

That will transform the ties binding China to suppliers even if, in the short term, as Erica Downs at the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs points out, the volumes required mean it will still lean on the likes of Saudi Arabia’s Aramco, Russia’s Rosneft, and Brazil’s Petrobras. While some countries, such as the United Arab Emirates, have sought to diversify into solar and forge other ties with China, not all have.

China’s relationships with Europe and the U.S. could also change. China accounts for 4% of the world’s petroleum output and a roughly similar proportion of its natural gas. By contrast, it mines almost 60% of the world’s rare earth minerals used in rechargeable batteries for electric cars, lasers, and wind turbines and processes more. China is the largest aluminum producer by far and dominates the extraction of graphite used in solar panels and batteries. Beijing has a tight grip on lesser-known minerals such as scandium, germanium, and tungsten—all on the European Union’s critical list of resources with high economic importance and at risk of supply disruptions, as Western governments begin to face the reality of their own vulnerabilities.

There are challenges for China. For one, managing the country’s strategy with a handful of national oil companies is easier than handling dozens of enterprises and negotiating with a range of producing nations. The technical capabilities of bureaucrats and diplomats will need to improve, says Michal Meidan of the Oxford Institute for Energy Studies. Ownership isn’t enough to exercise control.

New sources of conflict may emerge, too. Hydropower was a key plank of the 2060 plan to hit carbon neutrality. Damming rivers is a quick way to produce clean energy, and China already accounts for more than a quarter of the world’s total hydropower capacity. But China’s position upstream on crucial waterways like the Mekong or the rivers that flow off the Tibetan plateau could become a problem for its downstream neighbors.

While it’s unclear if a more confident and independent China will behave differently on the global stage, Beijing has prepared for the future of energy. So should the rest of the world.

Ferreira Marques is a Bloomberg Opinion columnist covering commodities and environmental, social, and governance issues. This column doesn’t necessarily reflect the opinion of Bloomberg LP and its owners.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein