Resolving the breach should, in theory, allow the Organization of Petroleum Exporting Countries and its partners to proceed with plans for reviving output still shuttered since the pandemic. The 23-nation block is aiming to restore supplies in installments of 400,000 barrels a day through to late 2022.

The market has shown it’s thirsty for additional supplies. American crude inventories declined substantially again last week, according to an industry report published ahead of government data due later on Wednesday. The nation’s oil demand has soared to new heights, with gasoline and diesel returning to pre-pandemic levels.

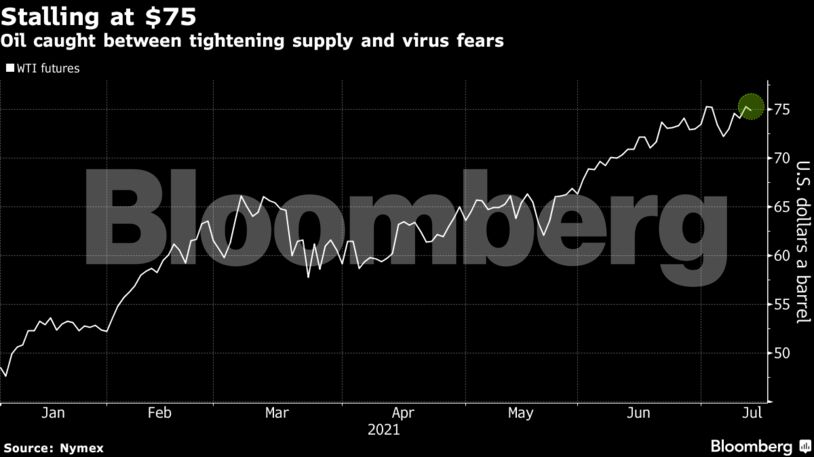

Oil has rallied more than 50% this year as the vaccine rollout lifts demand in major economies such as the U.S. and China, and fosters a recovery in Europe. Futures prices are showing a premium on nearer-term contracts, known as backwardation, which usually indicates tightness.

The International Energy Agency warned on Tuesday that the market will tighten significantly if the OPEC+ alliance doesn’t resolve the standoff.

Yet the global outlook faces a growing threat from the spread of the coronavirus variant. Indonesia posted a record number of positive cases, while Sydney extended a lockdown.

“Trouble is brewing for the oil market,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. “Fears are mounting that rising Covid-19 Delta cases could delay a full economic recovery. This, in turn, poses a significant threat to oil demand growth in the near-to-medium-term.”

| Prices |

|---|

|

The American Petroleum Institute said crude inventories slid by more than 4 million barrels last week, according to people familiar with the data. The Energy Information Administration is expected to report a similar reduction later on Wednesday, according to a Bloomberg survey.

That would be an eighth straight weekly draw, the longest run of declines since January 2018. A surge in petroleum use for products such as plastic, asphalt, lubricants and other industrial needs is helping to propel the recovery.

See also: Iran Talks Seen Withering Until August as Oil Market Heats Up

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS