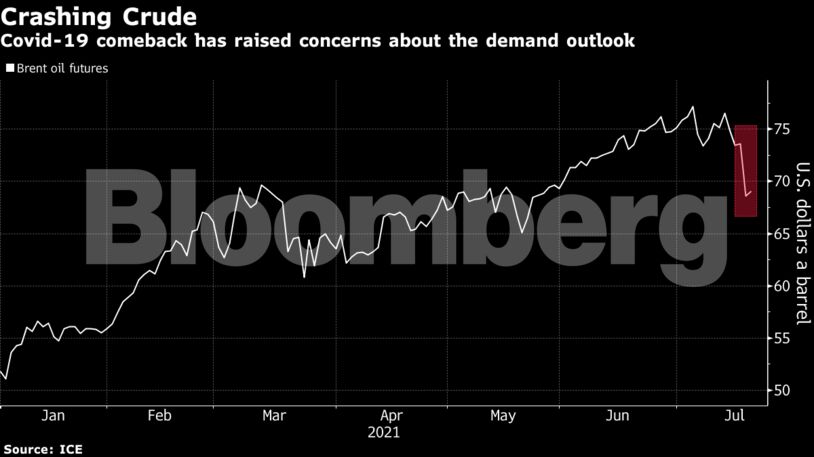

Oil’s upward trajectory has reversed in July, with the latest virus waves demonstrating the uneven nature of the economic recovery. Goldman Sachs Group Inc. said the delta variant may curb global oil demand by 1 million barrels a day for a couple of months, though that’s offset by a slow production ramp-up from OPEC+.

“As things stand, it is hard to see prices staging a comeback unless virus jitters are brought back under control,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates.

| Prices |

|---|

|

Signs of delta’s continued impact on energy abound. The U.S. has warned citizens to not travel to the U.K. and Indonesia amid an increase in infections there. Southeast Asia’s largest economy has surpassed India in new daily cases, becoming the continent’s new virus epicenter, while several of its neighbors are also seeing a surge in infections.

Nevertheless, there are expectations that the oil market will tighten and prices will once again rally. OPEC+ has agreed to keep gradually reviving output shuttered during the pandemic, but market watchers warn the increases aren’t enough to fill the looming supply shortfall.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire