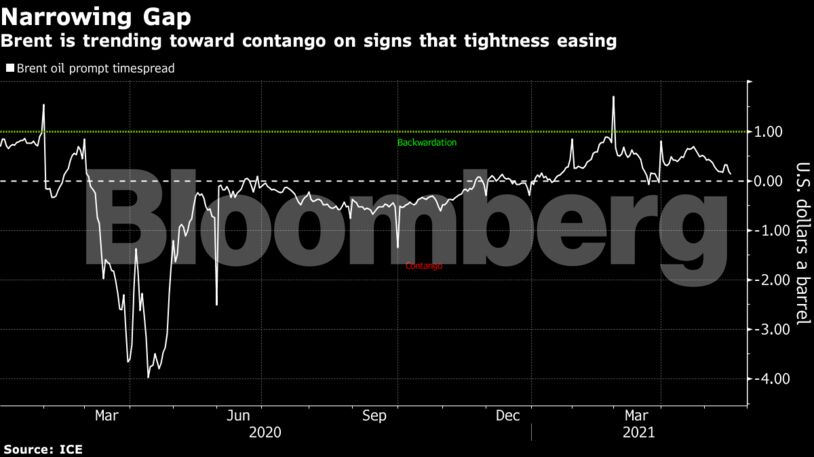

The prospect of a return of supply from the OPEC member state is being reflected in Brent’s prompt timespread, with its backwardation narrowing to just a few cents, a sign that market tightness may be easing.

While Brent briefly topped $70 a barrel earlier in the week, it has struggled to sustain that move. The market has been rattled by the outlook for Iranian production, though a timeline for a deal remains unclear. There’s also been a selloff in global markets, while the coronavirus continues to impinge on Indian demand, trimming sales of gasoline and diesel by as much as 20% for top refiner Indian Oil Corp.

A “revival of Iranian oil exports takes a lot of attention currently,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “The key question is when” a deal will be reached, he said.

| Prices |

|---|

|

Enrique Mora, the EU official in charge of coordinating diplomacy in Vienna for the nuclear talks, said he expects all parties to return to the 2015 agreement before Iran’s presidential elections on June 18. Citigroup Inc. sees an initial 500,000-barrel-a-day increase in supply from around the middle of the third quarter.

| Other oil market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein