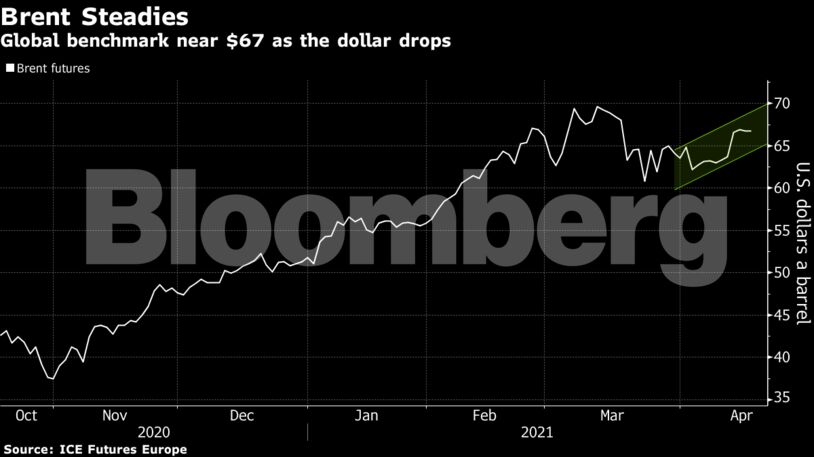

Oil has risen almost 30% in 2021 in a stuttering advance as Covid vaccinations are rolled out, but infection flare-ups in some countries continue to weigh on demand. After OPEC and its allies presided over supply cuts to drain bloated stockpiles, the cartel now plans to start restoring barrels in May. Yet high global Covid-19 cases temper hopes for an imminent end to the pandemic.

“With global virus cases hitting new records, the prospect for a sustained rally at this stage seems limited,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “Oil’s true upside potential cannot be realized before it can fire on all cylinders; that is currently not the case.”

| Prices |

|---|

|

Traders are also following high-level talks between Iran, the U.S. and other nations aimed at ending a standoff over the nuclear deal abandoned by former President Donald Trump. Washington described negotiations as “constructive,” while the Islamic Republic signaled it was ready to debate details to revive the accord. An agreement could see U.S. sanctions on Iranian oil exports lifted.

In Asia, some physical crude grades have grown in value in recent weeks. Russia’s ESPO crude, a staple of Asian refiners, is trading at a premium of more than $2 a barrel to the benchmark Dubai price. However, it’s a different picture in Europe, where Caspian CPC Blend is trading at a one-year low.

| Related news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso