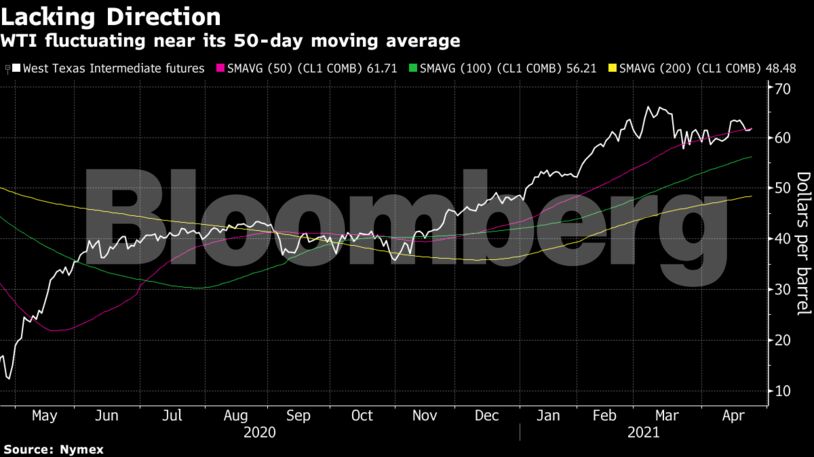

The market has been torn between divergent demand indicators this month, pushing West Texas Intermediate into weekly swings between gains and losses. Latest data showed robust manufacturing figures in Europe, though India continues to set a record number of daily cases. The country’s diesel and gasoline consumption could fall by a fifth this month, and traders said the nation’s largest refiner had refrained from buying West African oil this week, defying expectations.

Oil is more than 25% higher this year, aided by the rollout of Covid-19 vaccines and vigilant supply management from the Organization of Petroleum Exporting Countries and its allies. But the bulk of crude’s advance came in the first two months of the year, and prices have struggled since. OPEC+ is set to start easing deep supply curbs from May, and the group is expected to hold a full ministerial meeting next week to assess the global state of play.

“Oil prices have been fairly steady this week given the circumstances with a lot of factors pulling in different directions,” said Jens Pedersen, a senior analyst at Danske Bank. Prices have been pulled between U.S. supply, a weaker dollar and the potential lifting of sanctions in Iran, he said.

| Prices |

|---|

|

As India’s outbreak worsens, the nation’s combined consumption of diesel and gasoline is poised to plunge by as much as 20% in April from a month earlier due to renewed restrictions, according to officials from refiners and fuel retailers. Meanwhile, Japan is facing an increase in cases and a state of emergency will be declared from Sunday to May 11 in cities including Tokyo.

There is also concern about the potential for a rise in cases around Ramadan, when millions of people typically head home to regional towns from urban centers. Southeast Asia’s biggest predominantly Muslim nations, Indonesia and Malaysia, will limit travel toward the end of the monthlong fasting period.

| Related news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein