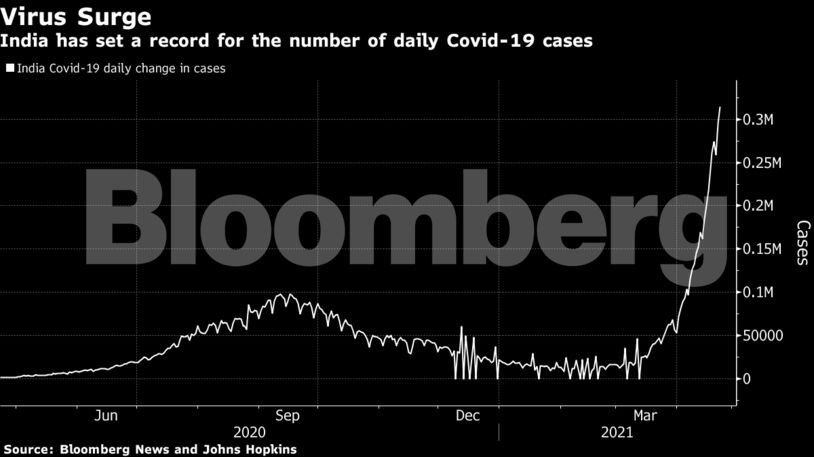

West Texas Intermediate rose 0.2%, having earlier dropped 1.2%. While concern has grown over the scale of the outbreak in India, where cases have topped 300,000 a day, gasoline demand in the U.S. has improved and U.K. road-fuel sales recently exceeded pre-pandemic levels.

On the supply side, the OPEC+ coalition is set to start returning more barrels to the market next month, while traders are also watching for a potential relaxation of American sanctions on Iran, though the U.S. has talked down the prospect of an imminent deal. On Wednesday, U.S. government data showed the first increase in nationwide crude stockpiles in a month.

“The untamed virus in certain parts of the world, coupled with a negative U.S. inventory report and the progress in the Iranian nuclear talks, has made oil bulls careful and conservative,” said Tamas Varga, an analyst at PVM Oil Associates Ltd.

| Prices |

|---|

|

Even as persistent Covid crises threaten demand, some countries are mapping out plans to open up. Among them, France will lift curbs on regional movement and reopen schools in the coming weeks, and Greece will ease most lockdown measures in May before welcoming back tourists.

| Related coverage |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein