Mar 20, 2021 Jet fuel has proved to be the weakest link in the oil market since the emergence of Covid-19. Lockdowns early last year quickly led to travel restrictions, hundreds of parked airliners, and an overwhelming amount of the fuel planes use with nowhere to put it. Demand for jet fuel plummeted to the lowest on record last summer.

“The U.S. is picking up,” Amrita Sen, chief oil analyst at Energy Aspects Ltd., said in a Bloomberg Television interview. “Potentially even within Europe, down the line, things will pick up,” she said. A full-fledged recovery is unlikely until travelers can resume crisscrossing the globe like they did before the pandemic, she said. “International travel constitutes the largest portion of jet demand, and I don’t think we’ve still worked out vaccine passports.”

Domestic passenger bookings have risen in recent weeks and U.S. airlines plan to respond by adding more flights to meet demand, according to Airlines for America. But the industry trade group said business still remains down about 50% in the U.S. from pre-pandemic levels and more than 60% internationally.

The U.S. load factor — the average percentage of seats sold per plane — has started to rebound as well among some of the largest domestic carriers, like United Airlines Holdings Inc., American Airlines Group Inc. and Delta Air Lines Inc., according to Bloomberg data. As of now, the recovery is being led by leisure travel rather than business trips, said George Ferguson, senior aerospace and airline analyst at Bloomberg Intelligence

“Most of the bookings are coming through online travel agencies, so it looks like a very price conscious, younger traveler,” he said. “A business and international rebound is late this year at best.”

To deal with mounting jet fuel stockpiles last year, refiners added the product to diesel and fuel oil to get rid of it, putting markets on unsure footing. A stronger jet fuel market is key to the oil market’s overall recovery.

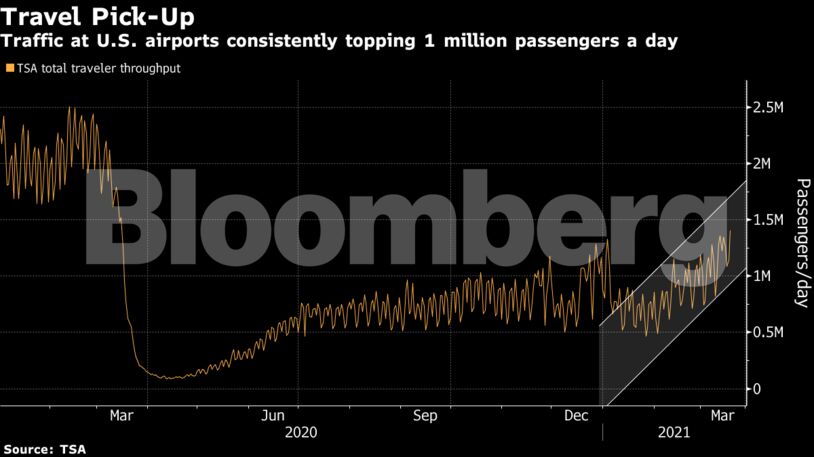

Consumption of jet fuel in the U.S. has held above 1 million barrels a day since October, a marked improvement from the end of May 2020 when demand was around 600,000 barrels a day.

Still, the aviation product needs to climb much closer in value to that of diesel to signal true health, said Thomas Finlon, chief operating officer at Brownsville GTR, a trading and logistics firm in Houston.

Gulf Coast jet fuel traded at about 17 cents a gallon below diesel Friday, compared with a spread of about 5 cents in early 2020.

(Bloomberg)

Cash Market Trade

Share This:

Oil’s Hardest-Hit Market Sees Hope in U.S. Airport Traffic Bump

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS