But a borrowing opportunity like this is hard to resist, and while it could be used to fund an expansion, it also makes sense to replace more costly debt with lower-cost bonds. Time will tell which it will be.

“Many may not be able to resist the siren song of historically low interest rates,” Spencer Cutter, an analyst at Bloomberg Intelligence, wrote Monday in a report. “As market conditions started to improve from the shock of negative oil prices in April, companies jumped at the chance to refinance debt.”

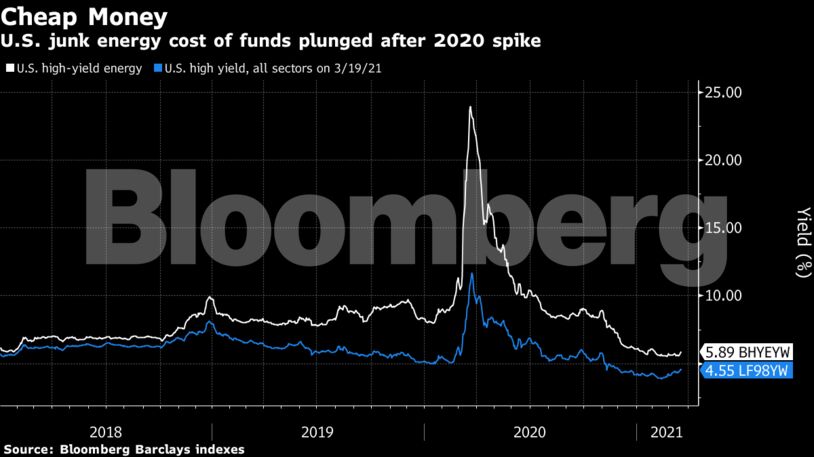

The sales continued on Monday when three more energy companies launched junk bond deals. The yield on the independent energy segment of the Bloomberg Barclays High Yield Energy Index dipped below 5.3% last month, touching the lowest level since 2014.

Occidental Petroleum Corp., Apache Corp. and Continental Resources Inc. were among the largest issuers of high-yield energy debt last year, helping boost total issuances to $13 billion during the second half of last year. They’re followed this year by names such as Antero Resources Corp., Comstock Resources Inc. and Hilcorp Energy Co.

Illustrating how much the interest rates have declined, Chesapeake Energy Corp. 2029 bonds that were issued last month were priced to yield 5.875%. That’s roughly half the yield of the bonds the company sold in late 2019.

Such low borrowing costs could lead some producers to fund expanded drilling programs, Cutter wrote. Oil activity in the U.S. has been on the rebound since August, when drilling plunged to the lowest in more than a decade. With a total of 318 active oil rigs in the U.S., explorers are still far from the 683 they had drilling for crude late in March 2020, according to Baker Hughes data.

It’s not just U.S. shale explorers that want in on the lower rates. Canadian exploration and production company Teine Energy Ltd is seeking $400 million to refinance existing debt. Water infrastructure company Solaris Midstream Holdings LLC, which operates in the Delaware and Midland basins, is also asking investors for $400 million to refinance debt and for general corporate purposes. And Oasis Midstream Partners LP, which operates in the Williston and Delaware basins, is marketing $450 million of new notes.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso