All told, five Korean conglomerates will invest 43.4 trillion won ($38 billion) in hydrogen technology by 2030, the Ministry of Trade, Industry and Energy said this month. That compares with Europe, where France, Germany, Italy, Spain and Portugal will pump a total of $44 billion of government funds into hydrogen this decade, industry researcher IHS Markit estimated in December.

“South Korea is definitely at the forefront of the hydrogen economy along with the Europeans,” said Alex Klaessig, director of gas, power and energy futures at IHS Markit in Cambridge, Massachusetts. The Koreans are more focused on the downstream elements of the value chain than the Europeans and they’ll probably import hydrogen for the time being, he said.

South Korea has stepped up its embrace of hydrogen since it followed China and Japan in setting a carbon neutral goal. The announcement of that 2050 target followed Seoul’s release of a Green New Deal that aims to triple renewable electricity generation by 2025. That will require a fast pivot away from coal and nuclear, which still account for almost half of power generation in the country.

See also: Hydrogen’s $230 Billion Funding Call Is Still Awaiting an Answer

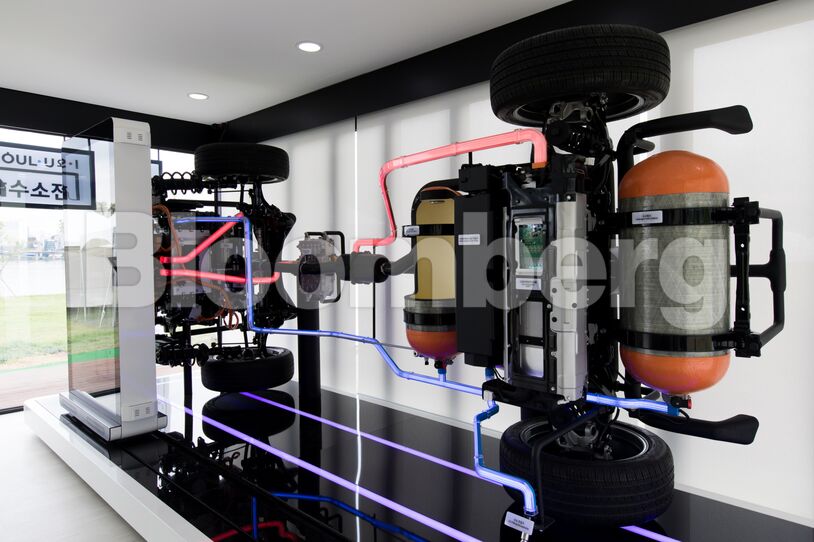

Posco has vowed to become carbon neutral by using and making hydrogen in its steel production, while Hanwha Energy Corp. built a 50 megawatt hydrogen fuel-cell plant last year. SK’s $1.5 billion investment in January in U.S. fuel-cell maker Plug Power Inc. is one of the biggest ever hydrogen deals.

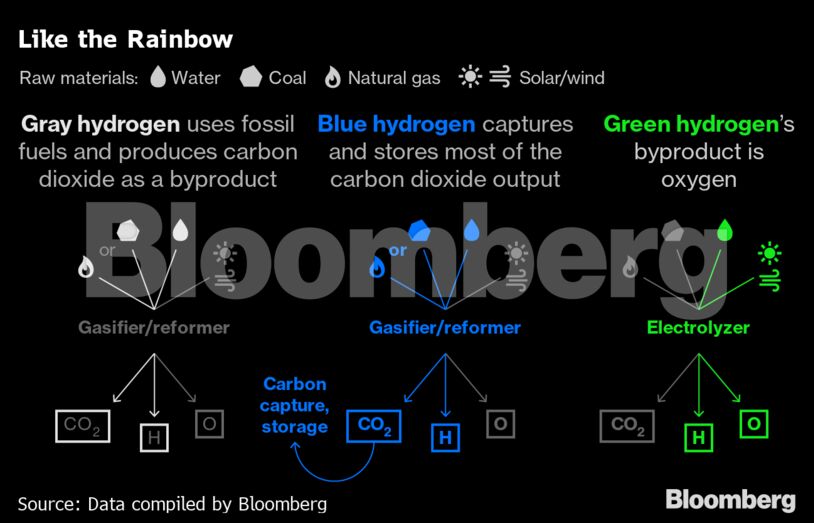

South Korea has made substantial hydrogen investments, with the bulk of it in the mid-stream segment, said Yong-Liang Por, a Hong Kong-based analyst at the Institute for Energy Economics and Financial Analysis. Green hydrogen, the cleanest form of the fuel, is “conspicuously missing” from the plan and this may need to be addressed to ensure security of supply as Posco will need almost 2 million tons of it per year to fully decarbonize its operations, he said.

Posco said in a statement on Thursday that it would work with local research institutes on extracting hydrogen from ammonia and also look to import more of the greenest type of the fuel.

Hydrogen projects will need to demonstrate to lenders they can generate more certain returns to attract the required $230 billion of funding this decade, according to French bank Natixis SA. The industry is plagued by a lack of cost-competitiveness, and government support to help create demand will make it easier to attract financing, said Ivan Pavlovic, the lender’s utilities analyst.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS