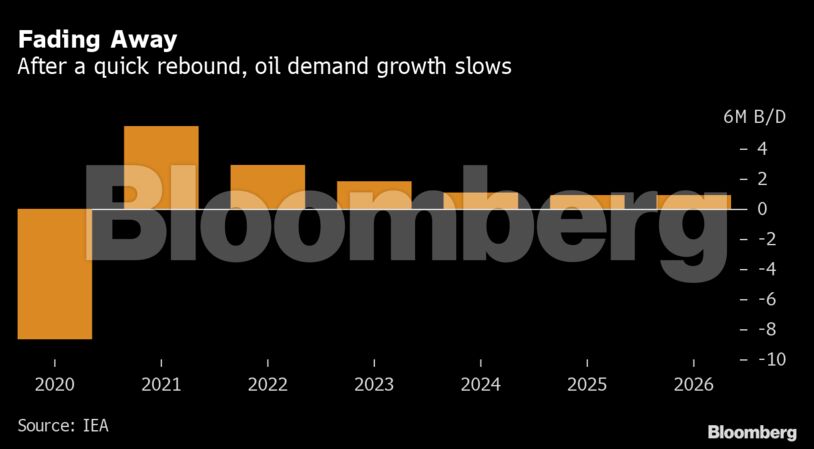

But as trends like remote-working endure, and as governments seek to limit climate change, hydrocarbon use will falter. Oil demand in the middle of this decade will be about 2.5 million barrels lower than the agency projected last year. Gasoline consumption has probably peaked already.

“Oil demand will likely never catch up with its pre-pandemic trajectory,” the Paris-based IEA said Wednesday in its annual medium-term outlook. “There may be no return to ‘normal’ for the oil market in the post-Covid era.”

Crude prices have already reversed last year’s plunge, rising to almost $70 a barrel in London. It’s partly because demand in Asia has held up, but mostly as a result of vast production cuts by the OPEC+ alliance led by Saudi Arabia.

Biggest Winners

The group’s member countries stand to be the biggest winners in the years ahead, reclaiming the market share they’re now sacrificing, the IEA said. For OPEC’s long-standing rivals in the U.S. shale industry, however, the agency’s outlook has dimmed significantly.

After a vigorous recovery in global demand this year and next in tandem with the wider economy, the IEA predicts that growth in consumption will slow, reaching 104.1 million barrels a day in 2026.

Asia will account for 90% of the growth, and much of it will be from petrochemicals and a gradual revival in aviation fuel, the IEA said. With electric vehicles becoming more widespread and internal combustion engines more efficient, demand for gasoline — for decades the cornerstone of the petroleum industry — will stagnate.

As consumption picks up, the Organization of Petroleum Exporting Countries and its allies will be able to reverse the massive production cuts they made in 2020. The need for OPEC’s crude will rise from 27.3 million barrels a day this year to reach 30.8 million a day in 2026.

Global crude markets could even begin to tighten around the middle of the decade if U.S. sanctions remain in place on OPEC member Iran. Saudi Arabia, Iraq and other Gulf exporters would need to pump near record levels in this scenario, and the group’s spare production capacity would dwindle to its lowest since 2016.

Falling Investments

For OPEC’s competitors, it’s a darker picture. Investment in new supplies tumbled by 30% last year as oil prices slumped, and will recover only “marginally” in 2021, the IEA predicted.

The steepest reversal of fortune has come for the U.S. shale oil industry, which once seemed set to squeeze OPEC almost indefinitely.

With companies compelled to rein in spending and reward shareholders after years of burning through cash — and many drillers increasingly mindful of investors’ environmental concerns — U.S. production will see only “modest growth.”

The country will remain the single biggest contributor to new supply in the outlook. But while it was forecast last year to provide the bulk of new supplies by the middle of the decade, the U.S. is now expected to account for just 16% of the growth to 2026.

“The industry is consolidating and is taking a more conservative approach to investment,” while “the availability of cheap capital is not as plentiful as it was in the boom years,” the IEA said. “The slowdown in U.S. production growth clears the way for OPEC+ to fill much of the supply gap.”

Lower Share

Still, any sense of victory for OPEC and its partners will be relative.

In five years OPEC+’s market share — at about 52% — will be lower than the 57% it controlled when the alliance formed in 2016. While OPEC nations stand to boost supply in coming years, this will largely consist of restoring output they halted, rather than deploying new capacity.

A further risk for OPEC+ and other producers is that the downside for demand could be deeper than anticipated, the IEA warned.

If governments act more swiftly on environmental reforms than expected, and consumers eschew business travel and embrace recycling, about 5.6 million barrels of daily oil demand could be eliminated by 2026.

“Demand could peak earlier than previously thought,” said the agency, which posited a plateau around the turn of this decade in its latest long-term outlook. “Stronger policies and behavior changes could bring a peak in demand soon.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein