By Andres Guerra Luz and Alex Longley

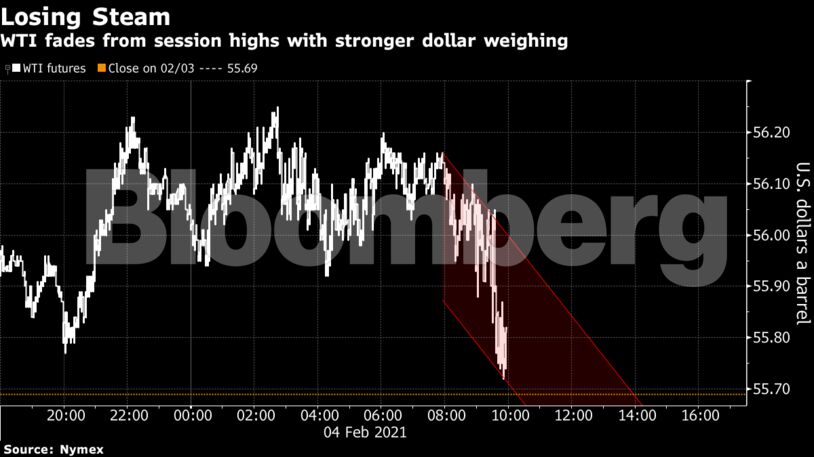

“There’s definitely some profit-taking, prices have been on a ripper,” said Bob Yawger, head of the futures division at Mizuho Securities. Meanwhile, “it’s never a good thing when the dollar is higher, so that could be serving as a resistance.”

Still, the setup is constructive for crude. With OPEC+ pledging to keep draining an oil surplus, inventories are dropping in China and stockpiles at a key storage hub in the U.S. are now below their five-year average. Meanwhile, Saudi Arabia is keeping oil pricing unchanged for its main market of Asia, defying expectations of a cut after a key OPEC+ committee expressed confidence that crude supply and demand are re-balancing. While a full-fledged demand recovery still has yet to take shape, oil consumption is poised to return to 2019 levels by the end of the year, according to Citigroup.

“At the moment we are seeing pretty good oil prices,” Shell Chief Executive Officer Ben van Beurden said in a Bloomberg TV interview. “Demand is not back where it was a year ago, but then again we see a lot of discipline also from OPEC+ and therefore the market is being held in balance quite well.”

| Prices |

|---|

|

Money is flooding back into the market. Total holdings of WTI crude futures are now at their highest level since July 2018, surpassing levels seen during the frenzied trading of April last year.

All the while, the crude futures curve continues to indicate strength. The so-called Dec.-Red-Dec. spread, a favored trade of the world’s hedge funds, has topped $3 a barrel in recent days to reach its strongest level in a year.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS