By Elizabeth Low and Alex Longley

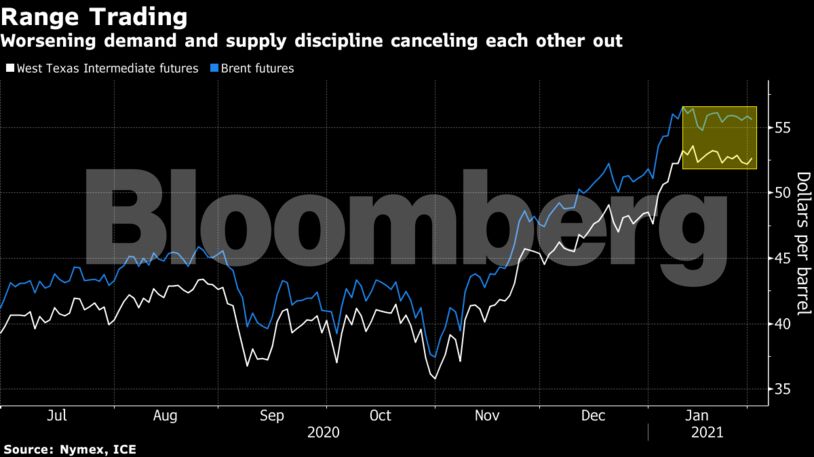

Keeping a lid on price gains, a Chinese purchasing managers’ index for manufacturing missed estimates in January, showing that efforts to rein in Covid-19 are affecting Asia’s largest economy. That compounded concerns that virus-related restrictions will stymie demand in the coming weeks. But with money flowing into commodities as vaccines are rolled out, and with OPEC+ still restraining output, there are hopes that inventories will fall sharply this month.

“Risk-on is one factor” driving oil prices higher, said UBS Group AG commodity analyst Giovanni Staunovo. “The second is the prospect of inventory declines over the coming weeks as a result of the Saudi production cut.”

| Prices |

|---|

|

Goldman Sachs Group Inc. said the rebalancing of the oil market continues to beat its above-consensus expectations, with the supply deficit seen averaging 900,000 barrels a day in the first half, compared with an earlier estimate of 500,000.

There were softer signs in the demand outlook from India, though. January diesel sales fell 5% from a month earlier, and were down 2.3% from the same period last year, according to preliminary data from officials with direct knowledge of the matter.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS