By Saket Sundria and Alex Longley

With crude starting the year strongly, Goldman Sachs Group Inc. said it expects Brent to reach $65 a barrel by the summer, sooner than previously anticipated. Last week, Saudi Arabia pledged deeper output cuts, a move that Goldman said will bring forward market tightness. The kingdom also increased its oil prices to Asia, and was followed by Iraq, Abu Dhabi and Kuwait.

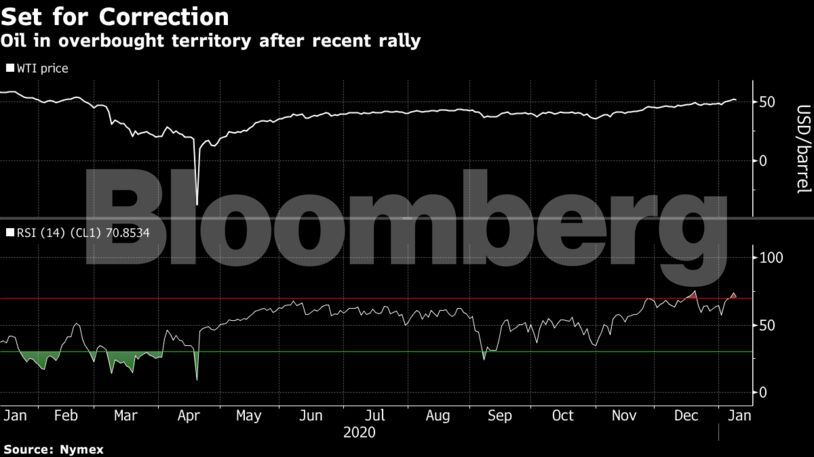

Oil has surged about 45% since the end of October after a series of Covid-19 vaccine breakthroughs raised expectations for a sustained rebound in fuel consumption, even though the rollout of shots will probably take some time. The broader commodity market is seeing renewed confidence from investors, with record wagers that oil, crops and metals are set to gain.

“The market has now reached a price level that potentially doesn’t reflect current fundamentals,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “Oil could be next in line” to suffer from a stronger dollar after other commodity prices came under pressure.

| Prices |

|---|

|

Saudi Arabia’s pledge last week for a unilateral output cut of 1 million barrels a day eased concerns about oversupply. WTI for February is at a premium to March, the first time that’s happened to the nearest contract since May. The structure, known as backwardation, indicates tight supply.

With crude markets starting the year on the front foot, there’s also been an uptick in trading activity. Combined holdings of Brent and WTI futures are at the highest since June, a sign that traders are adding new money to the market.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS