The International Energy Agency trimmed its demand forecast for next year, and doesn’t expect the crude glut built up during the pandemic to clear until December 2021. That was enough to counter positive data from China, which processed a record amount of crude on a daily basis last month as fuel consumption recovered.

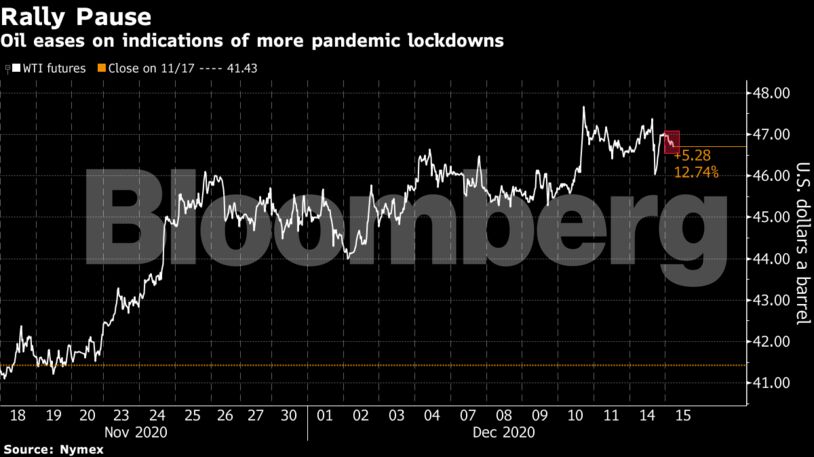

Optimism that fuel consumption will rebound following the roll-out of vaccines has helped to drive oil about 30% higher since the end of October. The near term outlook, however, is looking tougher, with OPEC also cutting its projections for demand in the first quarter of 2021 as the group and its allies prepare to start returning some crude supply to the market from January.

“Fundamentals point to a setback, considering new mobility restrictions,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “On the other hand, long-term oriented investors look still to rotate into cyclical commodities such as oil.”

| Prices |

|---|

|

It’s not just the U.S. and Europe that are seeing renewed measures that could impact fuel consumption either. In Asia, Japan suspended its domestic travel incentive system for two weeks after infections rose, while new cases in South Korea jumped.

The nearest portion of the futures and swaps markets are highlighting the mixed outlook. Brent’s prompt timespread was on the verge of a flip back into contango, where near-dated contracts are cheaper than later dated ones. That compares with a bullish backwardation of as much as 18 cents last week. At the same time, the Middle East Dubai benchmark has been moving further into backwardation.

“I’d expected a bit more pressure today after the announcements of the new lockdowns,” said Hans van Cleef senior energy economist at ABN Amro. “The tricky part is that after this week, liquidity will dry up, and then there is not much needed for a bigger price swing both ways.”

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS