By Ann Koh and Alex Longley

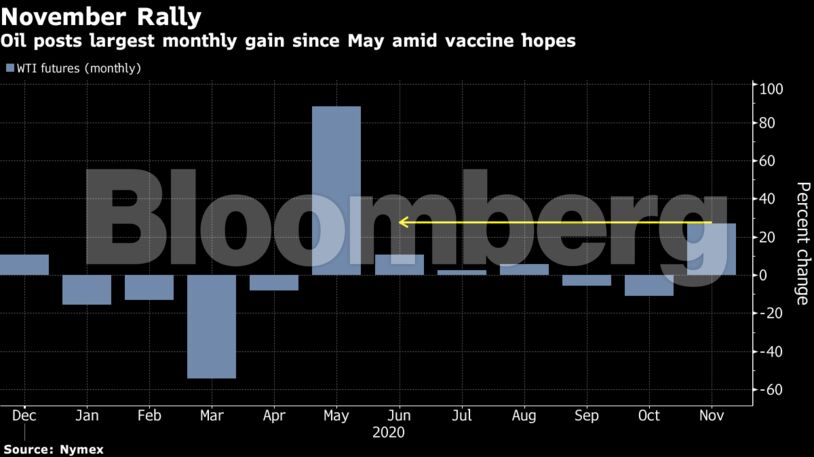

The talks have been complicated by oil’s biggest monthly gain since May and cracks have appeared in the alliance. Saudi Arabian Energy Minister Prince Abdulaziz bin Salman signaled his dissatisfaction with the situation on Monday by telling others he may resign as co-chair of a committee that oversees the output deal.

There had been some consensus building between ministers around keeping cuts for another three months, but friction has emerged with the United Arab Emirates on quotas, while Kazakhstan wavered on an extension. OPEC+ will probably have to make concessions that could be in the form of a shorter extension and then a gradual increase in production, Bob McNally, president of Rapidan Energy Advisors, said in a Bloomberg television interview.

“Some kind of compromise is still very, very likely to be reached,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “The market doesn’t seem to be too worried about the whole thing. And the reason is of course that we are getting increasingly closer to the Covid-19 endgame.”

| Prices |

|---|

|

OPEC+ is likely to agree on a face-saving compromise, with a short extension the probable outcome followed by a phased return of production, RBC Capital Markets analysts including Helima Croft wrote in a report. However, if cuts are eased, Brent oil prices are at risk of dropping back toward $40 a barrel and the market faces an oversupply of as much as 2 million barrels a day next quarter, Wood Mackenzie Ltd. said.

Global fuel demand, meanwhile, still remains shaky. Indian diesel sales in November dropped year-on-year after a festive boost in consumption proved fleeting, while a slow Thanksgiving for U.S. gasoline demand is foreshadowing what will likely be a tough season for fuel producers.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein