By Sharon Cho and Alex Longley

Futures in New York traded below $46 a barrel, driven by fluctuations in the dollar and equities. The U.K. issued its first Covid-19 vaccinations on Tuesday and there are signs that European demand is recovering after a renewed wave of lockdowns in the winter. Poland’s road use, for example, has climbed sharply since the start of last month.

WTI prices have been capped in the mid $40s since OPEC+ agreed on a slow return of production last week. The United Arab Emirates will provide Asian buyers with a little more crude next month after the deal.

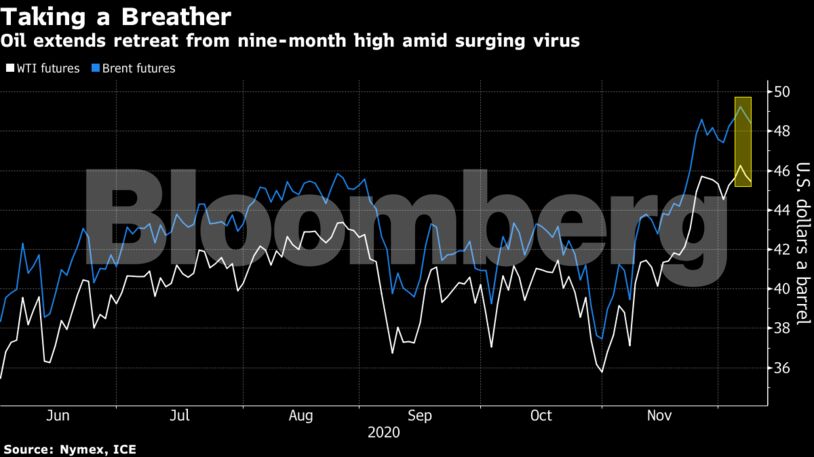

Oil is still near a nine-month high after surging last month amid optimism over vaccine breakthroughs and its trajectory over the next few months will depend on how quickly Covid-19 drugs can be deployed. In the near-term there are still ominous signs from the virus — the U.S. is now seeing hospitalizations rise by almost 2,000 a day and is averaging around as many deaths as during Covid-19’s first surge in April. France is poised to miss a goal to end its lockdown next week.

“We are confident that the weak demand will soon move back into the market’s focus,” said Eugen Weinberg, head of commodities research at Commerzbank AG. “The latest price rise has been driven by speculation.”

| Prices |

|---|

|

The oil futures curve, meanwhile, is signaling a slight increase in negative sentiment. Brent’s prompt timespread has moved back into contango — where near-dated prices are cheaper than later-dated ones — after surging last week.

While toughening restrictions to curb the spread of the virus remain a near-term headwind in Europe and the U.S., the recovery in Asia appears to be accelerating. Chinese exports jumped by the most since early 2018 last month. The strength in Asian demand led Saudi Arabia to raise oil pricing to the region and has also contributed to an increase in physical prices of North Sea crude.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS