By Ann Koh and Alex Longley

Futures dropped 2.2%, with equity markets also lower as investors took risk off the market. Joe Biden appeared to be on the brink of victory in the presidential race — amid increasing numbers of legal complaints from incumbent Donald Trump — but he may have to deal with a split Congress. Mounting coronavirus cases, with America becoming the first country to top 100,000 cases in a day, are also dragging oil lower.

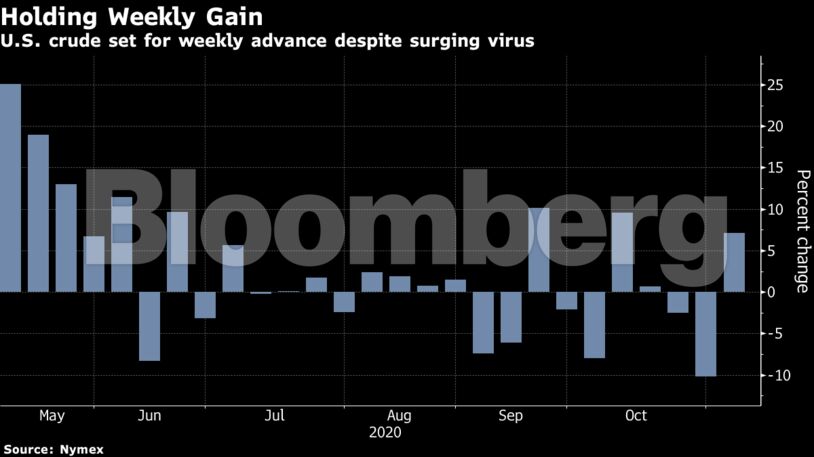

Crude is ending a rough week with a decline, after gains in the first few days, as the demand outlook turns more grim. Refineries across the U.S. and Europe have shut as a result of the pandemic and traders continue to brace for high volatility. Even though Asia is a bright spot, the OPEC+ group is considering whether to postpone a production increase scheduled for next year to prevent a market glut.

“There is a definite negative sentiment in Europe and around the world at the moment, due to the restored lockdowns that are mushrooming across countries and regions,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy.

| Prices |

|---|

|

With the market continuing to wrestle with abundant stockpiles, the world’s largest independent provider of oil storage said it has no space for hire at key fuel trading locations. Royal Vopak NV’s total occupancy rate was the highest its been for any three-month period since the start of 2019.

And with a glut of stored products across the world, refiners continue to struggle. Royal Dutch Shell Plc said it will shut its 211,000 barrel-a-day Convent facility in Louisiana as part of the company’s plans to shrink its refining business after Covid-19 hammered global demand and profits.

“It’s the pandemic, not the U.S. elections, that matter for oil in the near-term,” JPMorgan Chase & Co. analysts including Natasha Kaneva wrote in a report.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire