By Ann Koh, James Thornhill and Alex Longley

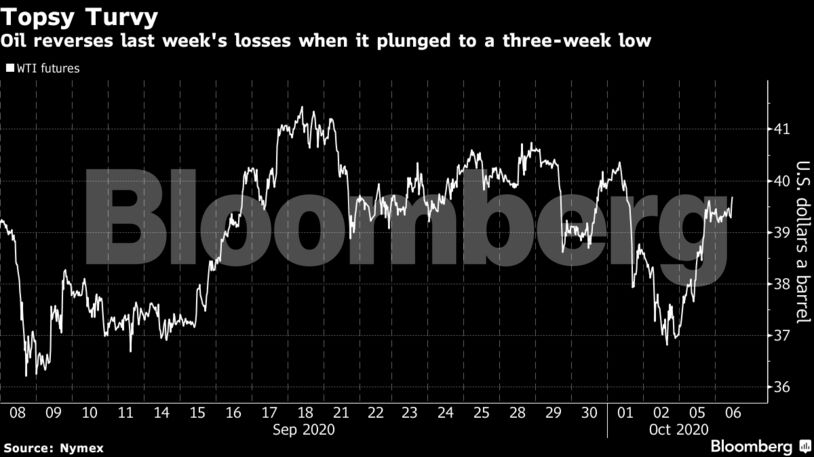

Futures added 1.2%, following Monday’s surge above $39 a barrel. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin will resume talks on Tuesday on another round of pandemic relief funding, but there’s no sign yet they are close to a deal despite Trump’s urging to get it done. The president will recuperate in the White House after his diagnosis last week roiled markets and pushed oil into the biggest weekly loss since June.

Crude rose on Monday as part of a broader market relief rally, and aided by a strike in Norway that has shut fields and is curbing flows. Masses of people in China are vacationing during the Golden Week holiday, displaying the country’s confidence in its economic rebound and public health measures. But the outlook for global oil demand remains patchy with stricter lockdowns coming into force in parts of Europe.

“This week is shrouded in upside risks, placing demand concerns to the background,” said Kevin Solomon, analyst at brokerage StoneX Group in London. “The promise of fiscal stimulus will continue to be a supporting factor.”

| Prices |

|---|

|

Moves in the oil futures curve was more circumspect on Monday, signaling underlying weakness. The nearest timespread for Brent, which helps gauge the health of the market, gained only 1 cent and later contracts remain more expensive than nearer ones, showing oversupply.

See also: The World’s Biggest Oil Trader Wants to Buy Your Used Car

Focus is also shifting to the weather with Hurricane Delta strengthening as it drifts toward the Gulf of Mexico. It could cause oil and gas production offshore Louisiana to shut down, and is threatening onshore refineries and shipping.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire