By Ann Koh and Alex Longley

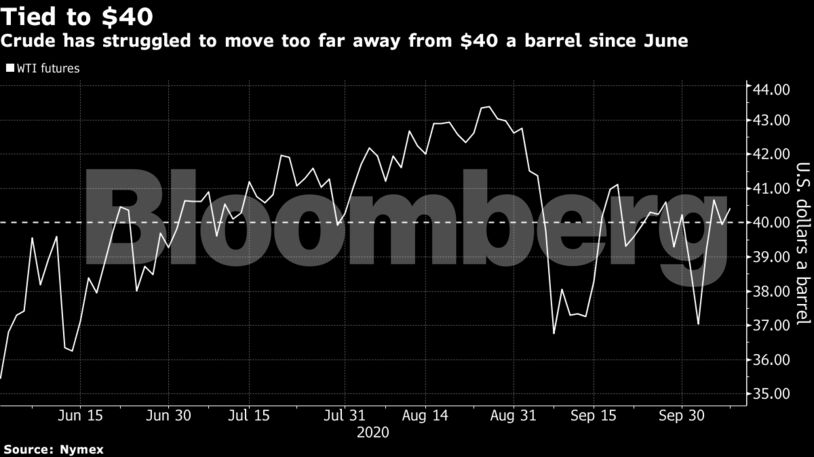

Oil remains tied to the $40 marker as the conflicted forces of American stimulus measures and flagging demand keep prices in check. There’s also the question of OPEC+’s next move, with Vitol Group expecting the organization to change course on plans to relax output cuts in January. For now though, focus remains on one of the most active hurricane seasons in recent memory.

“Hurricane Delta has supported the latest recovery” in prices, said Ole Hansen, head of commodities strategy at Saxo Bank. “Renewed stimulus hopes have generally given assets a risk-on boost.”

| Prices |

|---|

|

Traders are also looking for indications of Mexico’s secretive annual oil hedge. Many suspect that sharp declines in prices late last week were tied to the deal, though there hasn’t been the usual sign of activity in oil options markets.

Hurricane Delta has not only spurred operators to shut in production, but is also threatening to further depress crude demand from refiners that may face disruptions. Phillips 66 has paused the restart of its Lake Charles plant in southwest Louisiana as Delta heads for the state.

“All told we are working at a very low demand level with massive refining capacity and huge inventory surpluses everywhere you care to look,” Jan Stuart, global energy economist at Cornerstone Macro, said in a Bloomberg TV interview. “That’s just not a good level for oil prices recovering to a deployable level.”

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS