By Josh Saul

“You could think of it as a rat of debt working its way through the snake, and it takes a while for that to happen,” said Sprayregen, whose firm represented some of largest U.S. companies that went bankrupt during the pandemic. “A big wave has already happened and we have a semi-hiatus for maybe the rest of the year,” he said in a telephone interview Monday.

A distressed debt surge in the second or third quarter of 2021 will include bankruptcies and restructurings, said Sprayregen, a Kirkland partner who built its international restructuring group. Debt-for-equity swaps will also leave some companies with new owners, he said.

Besides energy, a large number of companies in the travel and leisure sector will need to address capital structures, according to Sprayregen, who splits his time between Chicago and New York.

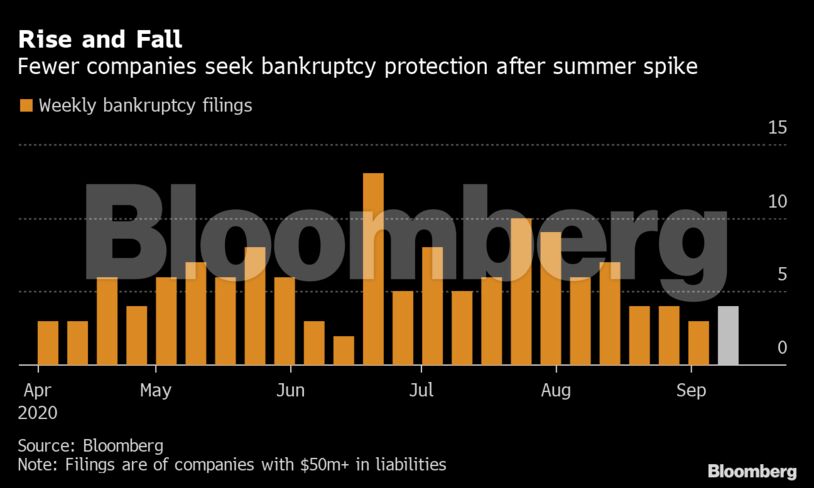

After a boom in corporate distress when economies shut down to deal with the pandemic, 2020 had been expected to be the biggest bankruptcy year ever. The pace of bankruptcies was widely expected to pick up after last month, which was slower than May-July, but still the worst August on record.

In the past week there were just four filings by companies with more than $50 million in liabilities, including iconic New York department store chain Century 21 Stores. That’s down from six filings a week, on average, from April to July, but in line with August’s weekly average.

Default Risk

There have been 187 bankruptcy filings year-to-date by companies with more than $50 million in liabilities, according to data compiled by Bloomberg. That’s the most for any comparable period since 2009, when there were 271 in the full year, the data show.

Global corporate defaults picked up after slowing in August, with five issuers added to the default tally last week, according to a Sept. 11 report from S&P Global Ratings, which highlights risk in CCC rated debt.

“So far in 2020, 152 out of 171 defaults, or nearly 90%, were from entities rated CCC and below before default,” said Sudeep Kesh, head of S&P Global Credit Markets Research.

Moody’s Investors Service predicted more pain to come for global oilfield services and drilling companies. In a report published Monday, it cites elevated refinancing as a potential cause of bankruptcies.

Distress Eases

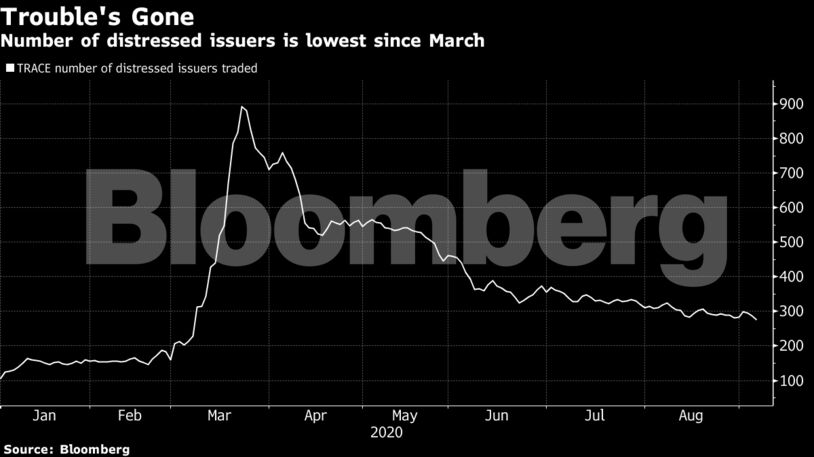

The total amount of distressed bonds and loans traded fell by 1.7% to $278 billion as of Sept. 11, the third straight week of declines. That’s down from $935 billion in March, data compiled by Bloomberg show. Volume of distressed bonds declined 0.9% while loans fell 3%.

Click here for a worksheet of distressed bonds and loans

There were 518 distressed bonds from 263 issuers trading as of Monday, down from 548 and 287, respectively, one week earlier. That’s significantly less than the 1,896 issues from 892 companies at the March 23 peak, Bloomberg data show.

American Airlines Inc. and Bombardier Inc. topped the ranks of issuers with the most debt trading at distressed levels that hadn’t filed for bankruptcy as of Sept. 11, data compiled by Bloomberg show.

| Distressed Issuer | Debt ($B) |

|---|---|

| American Airlines Inc | 9.6 |

| Bombardier Inc | 8.7 |

| Envision Healthcare Corp | 6.4 |

| Transocean Inc | 6.3 |

| CHS/Community Health Systems Inc | 5.1 |

| Diamond Sports Group LLC | 4.8 |

| AMC Entertainment Holdings Inc | 4.4 |

| Crown Finance US Inc | 3.4 |

| Ligado Networks LLC | 3.1 |

| EP Energy LLC / Everest Acquisition Finance Inc | 2.9 |

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS