By Saket Sundria and Alex Longley

The American Petroleum Institute reported crude inventories dropped by 6.36 million barrels last week, according to people familiar with the figures. That would be the longest run of declines this year if confirmed by government data on Wednesday. Yet, there are lingering concerns about the economy as U.S. companies added fewer jobs than expected, paring some of oil’s earlier gains.

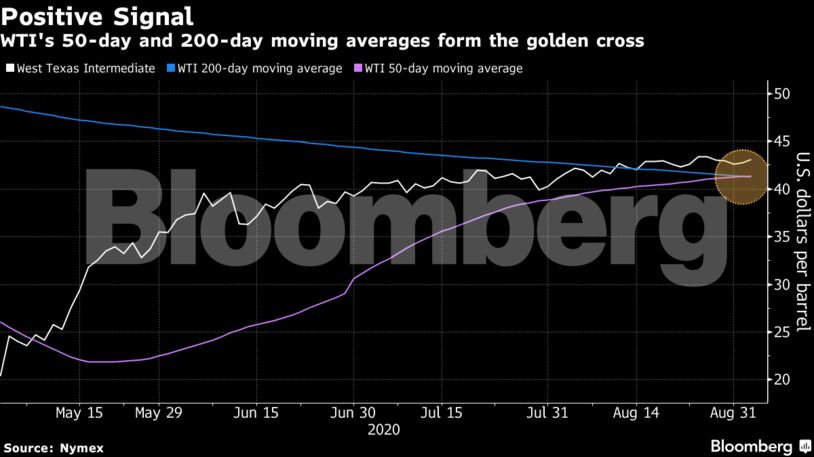

There was a positive technical signal for crude as West Texas Intermediate’s 50-day moving average rose above the 200-day marker for the first time in more than six months, forming a so-called golden cross and indicating that prices could break higher.

Oil rose for a fourth month in August but has struggled to sustain a rally above $43 a barrel as major economies continue efforts to contain the coronavirus outbreak. While a weaker dollar, sliding U.S. stockpiles and a surge in equity markets have supported crude, there are still concerns that a slow demand recovery is going to limit further gains.

“The positive tone is being sustained amid hints of a bigger-than-expected drawdown in U.S. oil inventories,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates. “Market players are currently riding a wave of optimism though it could come crashing down at any moment.”

| Prices |

|---|

|

American crude inventories — a key metric used to gauge global supply — have slipped from near record highs in June, helped partly by Saudi Arabia limiting shipments to the country. Cargo data show that deliveries in the week ended Aug. 28 dropped to what could be the lowest in decades.

See also: OPEC Supply Boost Tempered by Quota Cheats’ Extra Cuts

The longer-term outlook remains more uncertain. Demand may take a hit over September and October as Chinese imports ease with state-issued quotas for independent refiners dwindling following a crude buying spree earlier this year.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS