By Ann Koh and Alex Longley

Despite the rebound, prices remain below Tuesday’s open. Doubts linger over the strength of Asia’s demand recovery, U.S. consumption is set to ease with the end of the driving season and the easing of OPEC+ curbs on output are weighing on prices. The coronavirus pandemic is still raging and Bank of America Merrill Lynch said it will take three years for oil demand to fully recover from the outbreak even if there’s a vaccine.

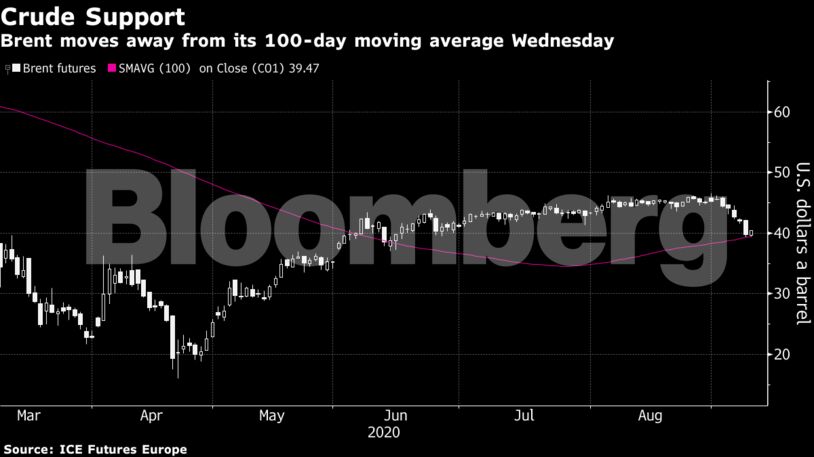

“Brent has managed to find support below $40 for a second day with the 100-day moving average attracting some interest,” said Ole Hansen, head of commodities strategy at Saxo Bank. “Overall, however, it is probably the improved risk appetite from rising stocks that has helped an overall challenged short-term fundamental outlook.”

| Prices |

|---|

|

In the near-term the market look soft, with the demand recovery fragile and inventories high, Morgan Stanley analysts Martijn Rats and Amy Sergeant wrote in a note and left its fourth quarter Brent forecast at $40 a barrel. However, the bank raised its estimate for the second half of next year by $5 to $50, on expectations of rising inflation and a weakening dollar.

See also: Oil Glut Trade on the Brink of Making Comeback in Blow for OPEC+

Combined with falling tanker rates, a weaker market structure is starting to make storing crude at sea an attractive proposition. Traders have also begun seeking out U.S. onshore storage, according to The Tank Tiger, an independent brokerage and consulting clearinghouse. The return of trading strategies that only work when the market is glutted is bad news for producers withholding supply to prop up prices.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS