By Alex Longley

Oil has clawed its way back after dropping below $40 a barrel earlier in the month, but the world’s biggest oil traders said Tuesday that the market won’t fully recover until 2022. It’s also contending with an increase in supply from OPEC+ members including Libya, which is boosting output as a blockade on its energy facilities lifts.

“Despite yesterday’s impressive rally in risk assets, investors will find it premature to become upbeat,” said PVM Oil Associates analyst Tamas Varga. “Demand data will probably bear more relevance,” than outright stockpiles in U.S. inventories, he said.

| Prices |

|---|

|

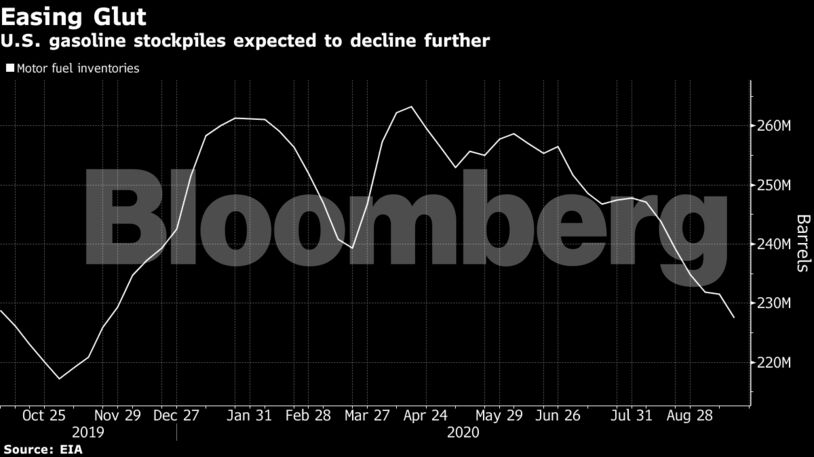

U.S. gasoline stockpiles fell by 1.2 million barrels last week for an eighth weekly draw, according to a Bloomberg survey. There were positive signs for the fuel in Europe too, as profits from turning a barrel of crude into gasoline hit their highest since June.

That comes as refiners are being forced into a balancing act due to the uneven rebound in fuel consumption. In India, processors are importing gasoline to cover demand as plants run below capacity, while in the U.S., refiners have idled some units to deal with access diesel supply.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS