By Saket Sundria and Alex Longley

In Europe, profit from making diesel on Thursday plunged to the lowest since at least 2011, signaling that demand is still weak. The global Brent benchmark was also under technical pressure as it broke below its 50-day moving average for the first time since May.

Futures have been whipsawed by the dollar this week, with a rising U.S. currency contributing to U.S. oil’s 2.9% fall on Wednesday. After gaining to near $43 a barrel, crude has faltered as the coronavirus continues to rage in many parts of the world and the demand outlook remains uncertain. Purchases by China, the world’s largest importer, are likely to slow as smaller refineries top out their shipment quotas.

“Oil has reversed the trend from August,” said Jens Pedersen, senior analyst at Danske Bank A/S. “It seems mostly related to the swift rebound in the dollar over the past days.”

| Prices |

|---|

|

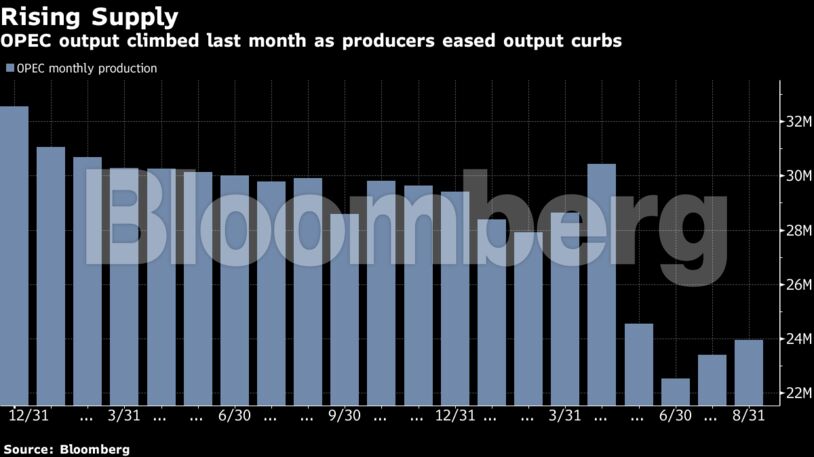

The market’s structure has also weakened in recent days. WTI’s near-term contracts are at their biggest discount to later ones since June, a structure known as contango that indicates growing concerns about oversupply.

Some parts of the physical market are also showing signs of renewed frailty. In the North Sea, where supplies help to price more than two-thirds of the world’s crude, traders offered five cargoes on Wednesday, following seven on Tuesday. No buyers emerged for any of those, suggesting potentially sluggish demand in the region.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS