By Andres Guerra Luz

“Gasoline demand is still low, inventories are high” as the pandemic persists, said Michael Hiley, head of over-the-counter energy trading at New York-based LPS Futures. “So if there ever was a time where we could tolerate losing some refining capacity, it would be now.”

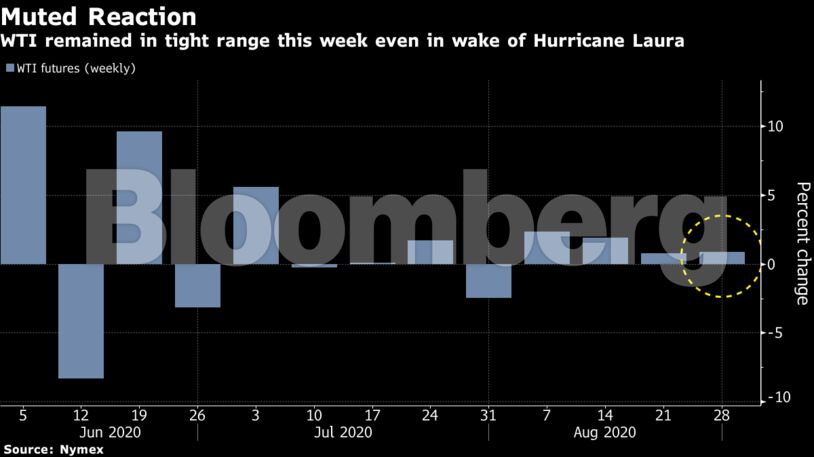

Refining margins for combined gasoline and diesel jumped 12% on Friday due to refinery closures in Southeast Texas and Louisiana because of Hurricane Laura. But the hurricane-related surge in U.S. Gulf Coast gasoline cracks likely won’t last, “given the ample unutilized capacity elsewhere and high product inventories,” according to a Jefferies report dated Thursday.

The pace of Covid-19 infections rose further in key European countries and German Chancellor Angela Merkel warned that more sacrifices lie ahead after the summer.

“The focus seems to be more on the demand front than supply at this point,” said Josh Graves, senior market strategist at RJ O’Brien & Associates LLC. “Until they get a vaccine developed and people are comfortable traveling again then you’re going to see much interest in being long energy markets, let alone being long crude.”

| Prices |

|---|

|

In a sign that China’s thirst for oil imports is waning, the number of supertankers hauling crude to the country slid to its lowest level since late March, according to ship-tracking data compiled by Bloomberg. The number of very large and extra-large crude carriers signaling China in the next three months dropped by two to 79 in the past week, compared with a seasonal average of about 88 tankers.

Meanwhile, the slowdown in demand is resulting in weaker margins for producing fuels, reducing the incentive for refiners to purchase more crude. In Europe, profit from turning crude into diesel weakened to its narrowest since June on Thursday, while that for gasoline in America was its lowest since April.

| Other market drivers |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire