By Mike Jeffers

Prices “will continue to be driven by inventories,” said Bart Melek, head commodity strategist at TD Securities, “and the idea that OPEC+ has spare capacity, which it can deploy to match the post-covid demand growth.”

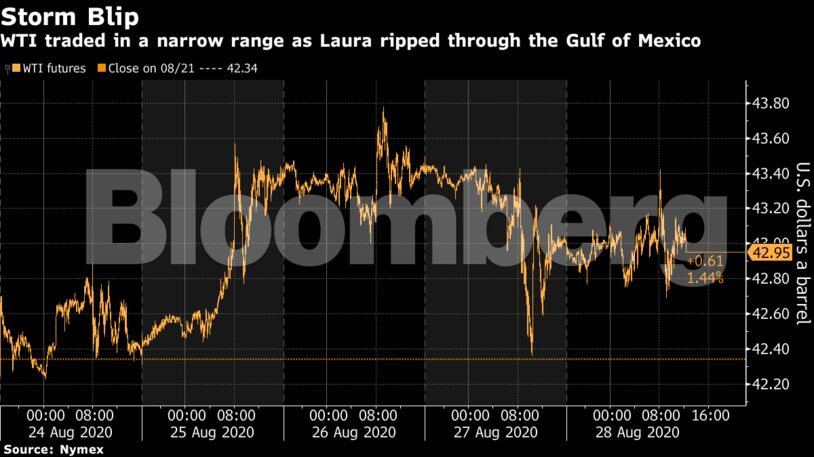

To be sure, futures prices briefly rallied in advance of the storm as the market braced for impact. WTI briefly touched a 5-month high on Wednesday, but stuck to a narrow trading range this week of $1.55 a barrel. Gasoline jumped 6.5% on Monday only to give back all of those gains plus some by Thursday’s close.

In preparation for potential supply bottlenecks, the number of ships on standby to carry gasoline from Europe to the U.S. doubled from the week before. By Friday morning, at least five of those fixtures were canceled, according to data compiled by Bloomberg. Meanwhile the spread between the September and October contracts for gasoline retreated to a weaker level than it was at before the storm hit.

The energy complex narrowly dodged a potentially catastrophic hit that would have snarled the delivery of stored fuel, leaving stockpiles stranded. The storm sliced through a narrow corridor between Houston and New Orleans and moved rapidly inland. Three years ago, Hurricane Harvey sat on top of Houston, where much more fuel is produced, for a week, flooding several plants.

“Laura flew by quickly,” said Jaime Brito, vice president at Stratas Advisors LLC in Houston. “Therefore the mid-term damage should be way less than typically expected from an event this size.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein