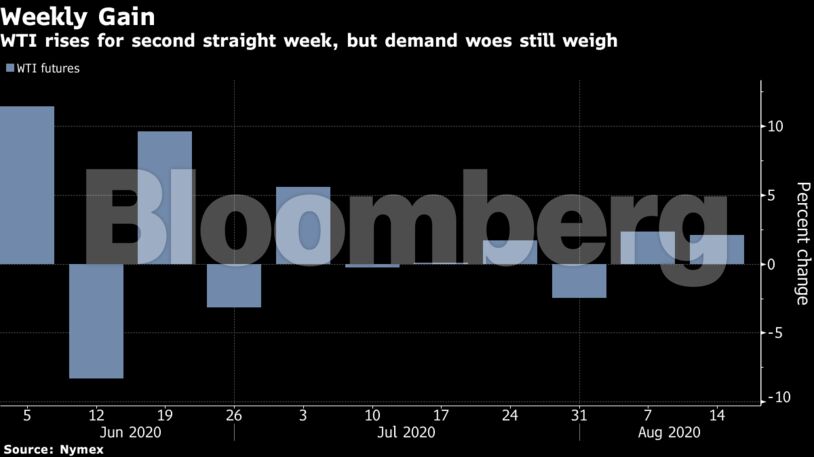

Oil Ekes Out a Weekly Gain With Pandemic Concerns Capping Rally

Crude futures in New York fell 0.5% Friday, but rose 1.9% for the week. The U.S. and China postponed talks planned for over the weekend that had been aimed at reviewing progress at the six-month mark of their phase-one trade agreement, according to people familiar with the matter. Meanwhile, a rebound in U.S. retail sales slowed sharply in July amid a surge in Covid-19 and still-high unemployment cooled the economic recovery.

“If China headlines come out and there’s a problem with the meeting that’s going to happen, you could see a push down to the support levels,” for crude futures, said Tariq Zahir, managing member of the global macro program at Tyche Capital Advisors LLC.

Still, U.S. benchmark crude futures extended their rally to over 4% in the past two weeks, with American crude stockpiles declining after imports from Saudi Arabia dropped and gasoline consumption rising. Adding to support, some data points show bright spots in the economic outlook, with U.S. industrial production increasing for a third straight month in July.

But growing signs of a resurgence of the coronavirus has highlighted the patchy recovery in oil consumption. On Thursday, the International Energy Agency downgraded a majority of its demand forecasts for the next 18 months. Meanwhile, the pace of well reactivations in the U.S. has increased since July, according to Rystad Energy, potentially casting a further pall amid a stubborn supply overhang.

“There’s reasons to be optimistic,” said Michael Hiley, head of over-the-counter energy trading at New York-based LPS Futures. But crude supplies are “one big spike away” from reversing the gradual recovery in prices “right back down.”

| Prices |

|---|

|

The 3-2-1 refining margin for combined gasoline and diesel against WTI, which provides a rough gauge of profitability for processing a barrel of crude, is trading at its lowest seasonal level in almost a decade. As the pandemic devastates air travel and depresses gasoline demand during what is usually the summer driving season, weakness in the margin signals the decreasing appeal for refiners to buy up more crude.

At the same time, prompt spreads for WTI and Brent futures both widened deeper into contango on Friday, signaling concerns of oversupply.

“With the cracks struggling, turnaround season looms large on the horizon,” Bob Yawger, director of the futures division at Mizuho Securities USA, said in a note. Refiners will “pull back on the run rate soon, but there is little incentive for them to run hard during winter because distillate storage is already very close to a 38-year high.”

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS